Snohomish County Housing Market Update — October 2025

- Joe Frank

- Oct 18, 2025

- 5 min read

This Snohomish County housing data is extracted from the NWMLS and has a one month lag (this is housing data as of 9/30/25).

If you'd like more real-time data for a more specific and accurate analysis relative to your unique property, area, and/or situation, please reach out and I'd be happy to help.

Housing data is extremely location sensitive. Even within a specific County, there are zip codes, communities, and even neighborhoods that defy the numbers discussed below. Of course when you zoom out and look beyond Snohomish and other counties, or even Washington State, you're likely to see dramatic difference from the housing data and trends discussed below.

You can view the latest Snohomish, Skagit, and King County housing data and charts along with other key housing and economic data here: www.joefrankrealtor.com/data

If you’d like to learn about a different area whether within Snohomish or Skagit Counties, or beyond, please contact me at joe.frank@exprealty.com and I’d be happy to provide you such data and an analysis.

The Snohomish County housing market continues to move with a quiet but steady energy as we closed out September 2025 and entered October.

If you're thinking of buying or selling, here's what you need to know - and what it might mean for you.

The Quick Numbers

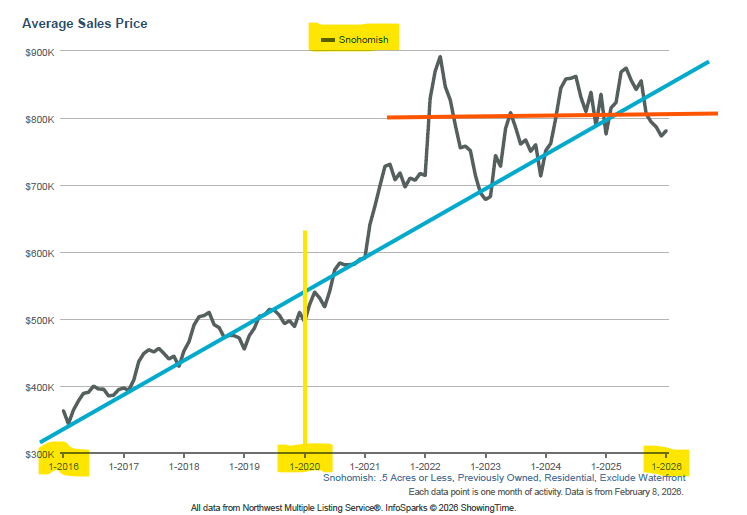

Average Sales Price dropped from $854,000 in August to $806,000 in September — a significant ~5.6% month-over-month dip.

New Listings rose to 616, up from 574 in August — indicating more sellers entering the market.

Inventory of homes for sale ticked up slightly to 908 from 874 in August — still relatively tight compared with historic norms, but edging toward more supply.

Days on Market (DOM) increased from 26 in August to 29 in September — homes are taking a little longer to sell.

Final Sales Price as % of Original List Price drifted down to 97.2% (from 97.6%) and off the spring high of ~101.2% in April — sellers are accepting slightly more concessions.

Price per Square Foot remained steady at $424, down from a peak of ~$454 in June — indicating leveling in value per unit area.

What this means for buyers & sellers

For Buyers:

You’re seeing more opportunities. The drop in average price, the slight uptick in inventory, and the longer DOM all combine to give you more leverage than earlier in 2025. Homes still sell — the market hasn’t stalled — but buyers can now ask more questions, negotiate more confidently, and take a little more time (though not forever). If you’re considering buying in Snohomish County, you’re stepping into a market that’s transitioning from “frenzy” toward more balanced.

Tip: Watch pricing carefully — homes priced aggressively or needing lots of work may linger, so pick well-positioned properties (good location, condition, pricing) and budget for rate/renovation risk.

For Sellers:

The market still leans toward you — average price is high by long-term standards and demand persists — but the “quick sale at full price” era is less forgiving. With list-to-sales numbers dropping, you’ll need to show the house well, price it right from day one, and be open to realistic negotiations (perhaps credits for rate buydowns, inspections, or flexible closing).

If you wait for “perfect conditions,” you might lose momentum.

Tip: Consider listing sooner rather than later if you’re ready — you may avoid increased competition and the seasonal slowdown typically in late fall/winter.

The Underlying Dynamics

1. Interest Rates & Affordability:

Mortgage rates remain elevated compared to the ultra-cheap years. Higher rates reduce what a buyer can afford, which tightens the effective demand pool. That affordability pinch is one reason we’re seeing average prices dip and sellers getting slightly less than list price.

2. Supply Creep:

Inventory is rising, albeit slowly. More listings mean more choice for buyers and slightly more negotiation room — it’s a shift from a red-hot seller’s market toward something more moderate. When supply meets demand more evenly, prices tend to level or consolidate rather than shoot straight up.

3. Buyer Behavior & Expectations:

With rates high, many buyers are cautious. They’re more demanding and most will want move-in ready, ideal location, and real value. This pulls premium for “turn-key” homes, while homes with more work or higher list price can sit longer. Sellers need to meet those expectations.

4. Local Employment / Population Trends:

Snohomish County continues to benefit from the broader Puget Sound region’s job market (tech, aerospace, healthcare) and lifestyle appeal. That underlying demand keeps support under the market. Unless there’s a major job loss shock, this fundamental will keep housing resilient.

5. Seasonal & Micro-Market Effects: September often marks a seasonal transition (summer to fall). Many sellers rushed to list in spring/summer; now we’re seeing the tail end.

Also, not all parts of Snohomish behave equally — some neighborhoods continue strong, others more sluggish. It's always important to look at ZIP-level / local street comparisons.

Looking Ahead: What to Expect

Short-Term (next 3-6 months): Expect more of the same: cautious price dips or flat pricing, modestly increasing inventory, slightly longer days on market. Buyers should act when they find a strong-value home; sellers should avoid listing overpriced or un-conditioned homes and instead focus on value.

Mid-Term (2026): If mortgage rates ease (e.g., drop back toward ~ 5.5 to 6% range), affordability improves and we could see renewed upward pressure on prices. Conversely, if rates rise or job growth slows, the market could drift sideways for a bit, or prices fall a bit more dramatically. My thoughts -- in many parts of the US, and locally, we're seeing a slight price correction, definitely not a crash. And to be honest, this "correction" or recalibration was needed. Home prices simply increased too high, too quickly and it was not sustainable. We'll likely see prices continue to stabilize and perhaps dip a bit further until the spring listing season which begins around March. Of course if their are any economic, political, or war shocks, it would change this assessment.

For Your Home’s Worth: If you already own, your home likely still holds value (especially if in good condition, good location). But don’t count on double-digit rapid appreciation for now. If you’re selling in the next 6 to 12 months, make sure pricing and presentation reflect this more balanced market. If buying, you may get a better deal now than you would have six months ago — but still plan for long-term hold and assume modest growth, not big jumps.

Final Word

In Snohomish County’s housing story right now: the sparkle of the ultra-hot market is off, but the foundation remains solid. For buyers, it’s a window of opportunity with more choice and negotiation room. For sellers, it’s a time for strategy, polish, and realistic expectations. And for both: staying informed, acting with wisdom, and picking the right property or timing will matter more now than ever.

If you’d like a personalized estimate of your home’s value (or what a comparable home you’re eyeing might cost), just say the word — happy to help!

As always, thank you for taking the time to read this article!

You can listen to the blog here:

Comments