August 2025 - Snohomish County Housing Market Update

- Joe Frank

- Aug 6, 2025

- 4 min read

Updated: Aug 23, 2025

This Snohomish County housing data is extracted from the NWMLS and has a one month lag (this is housing data as of 7/31/25).

If you'd like more real-time data for a more specific and accurate analysis relative to your unique property, area, and/or situation, please reach out and I'd be happy to help.

Housing data is extremely location sensitive. Even within a specific County, there are zip codes, communities, and even neighborhoods that defy the numbers discussed below. Of course when you zoom out and look beyond Snohomish and other counties, or even Washington State, you're likely to see dramatic difference from the housing data and trends discussed below.

You can view the latest Snohomish, Skagit, and King County housing data and charts along with other key housing and economic data here: www.joefrankrealtor.com/data

If you’d like to learn about a different area whether within Snohomish or Skagit Counties, or beyond, please contact me at joe.frank@exprealty.com and I’d be happy to provide you such data and an analysis.

The Snohomish County housing market continues to move with a quiet but steady energy as we closed out July 2025 and enter August.

If you're thinking of buying or selling, here's what you need to know—and what it might mean for you.

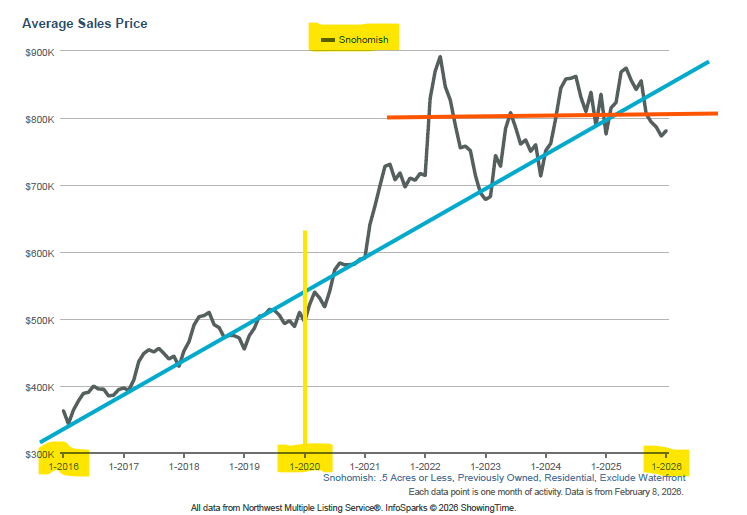

Home Prices: Holding Steady (But Off the Peak)

Average Sale Price as of July 2025: $831K

May 2025: $840K (peak prices of 2025 so far)

July 2024: $817K

Prices are up slightly year-over-year, but we’ve softened a bit from May’s seasonal high. This is typical as late spring often brings out the most aggressive buyers and sellers, while summer tends to settle. Still, homes are holding value well in Snohomish County.

Current Housing Inventory & New Listings: A Market with More Choices

Existing Homes For Sale (current inventory) as of 7/31/25: 2,439

May 2025: 2,111

July 2024: 1,717

New Listings as of July 2025: 1,420

May 2025: 1,709

July 2024: 1,167

From this data it's very evident that for Snohomish County (and most areas), inventory is increasing both by homes staying on the market longer (existing home sales) along with more homes being put on the market (new listings).

Buyers are benefiting from more options, and sellers are facing a more competitive landscape. For you sellers, pricing and presentation matter more than ever.

Buyer Activity & Demand - Average Days on Market

July 2025: 28 days

May 2025 (spring peak): 21 days

July 2024: 19 days

Homes are taking a bit longer to sell this year, and that’s not a bad thing. A jump from 19 to 28 days year-over-year shows the market is cooling just enough to give buyers some breathing room. It's not a slowdown, it’s a normalization. In fact, a 28-day average is still historically low, and homes priced right are still moving quickly.

Some additional July 2025 housing market data points to understand the current housing health:

Sale-to-List Price Ratio: 99%

On average, homes are selling for 1% under the original asking price.

May 2025: 97.6%

July 2024: 99.2%

This data point has been hovering around 100% over the last couple years which is a normal and healthier range. The days of getting 5 to 10% over asking are long gone. However, if as a seller, you price competitively and have a home that has sought after attributes or unique features, and that's well marketed, there's still potential to generate considerable interest.

Price per Sq Ft: $429

This is the average when you take the final sales price of a home and divide by its square footage. This value was $449 in May 2025 and $437 in July 2024. This value should mirror home prices.

Showings per Pending Sale: 12 (down from 14 last year)

The takeaway? Buyer demand is still strong, but shoppers are being more measured—as they have more homes to choose from.

What About Mortgage Rates?

Mortgage interest rates continue to hover in the 6.5 to 7% range. While not as shocking as the jumps we saw in 2023, they’re still high enough to slow some buyers down or shrink budgets. For sellers, this means pricing correctly from the start is crucial - today’s buyers are cautious and calculating.

The Fed hasn’t signaled any major rate drops in the near term, so we may be in this range for a while. That said, a softening labor market or cooling inflation could still nudge rates downward into 2026.

A great resource to monitor mortgage rates (fixed, variable, jumbo, etc) along with great commentary and insight is Mortgage News Daily. I also track on my data page.

What This Means for You

For Buyers:

More homes to choose from = better chances of finding the right fit.

Homes are sitting slightly longer, providing more time to conduct your due diligence on home candidates and make more thoughtful decisions.

But don’t wait too long or for big price drops (homes are still selling on average between three and four weeks!) - focus instead on locking in a home you love and refinancing later if rates drop.

For Sellers:

Your home is still worth a lot, but expect more competition.

A longer average DOM means patience may be needed, even if your home is priced well.

First impressions matter - price it right from the start to avoid the “why hasn’t it sold?” stigma.

Bottom Line

The Snohomish County market is much more balanced and healthy these days, and no longer overheated. It’s a market that rewards realistic expectations and smart strategy - whether you're buying your first home or selling your third.

Got questions about how this applies to your home or neighborhood? I'm happy to help.

If you want zip-code specific stats or neighborhood-level insights, I’ve got you covered - just reach out! I’m always happy to dig into local data to help you make confident decisions about buying or selling in our area.

Thanks for reading!

Cheers!

-Joe

You can listen to the podcast for this article below. Please note that the podcast is AI generated from this blog article.

Comments