May 2025 - Real Estate Health, Trends & Insights for Snohomish, Skagit & King County

- Joe Frank

- Jun 21, 2025

- 4 min read

Local Snohomish, Skagit, and King County Highlights as of the latest May 2025 real estate data.

My local housing data is extracted from the MLS and has a one month lag, so we are examining data as of 5/31/25. I have access to real-time data if you need a more accurate and specific analysis relative to your unique property, area, and/or situation.

Please know that housing data is location sensitive. Even within a specific County, there are zip codes, communities, and even neighborhoods that defy the numbers discussed below. Of course when you zoom out and look beyond Snohomish and other counties, or even Washington State, you're likely to see dramatic difference from the housing data and trends discussed below.

You can view the latest Snohomish, Skagit, and King County housing data and charts along with other key housing and economic data here: www.joefrankrealtor.com/data

If you’d like to learn about a different area whether within Snohomish or Skagit Counties, or beyond, please contact me at joe.frank@exprealty.com and I’d be happy to provide you such data and an analysis.

May 2025 – The One‑Month Story

Average Sale Price:

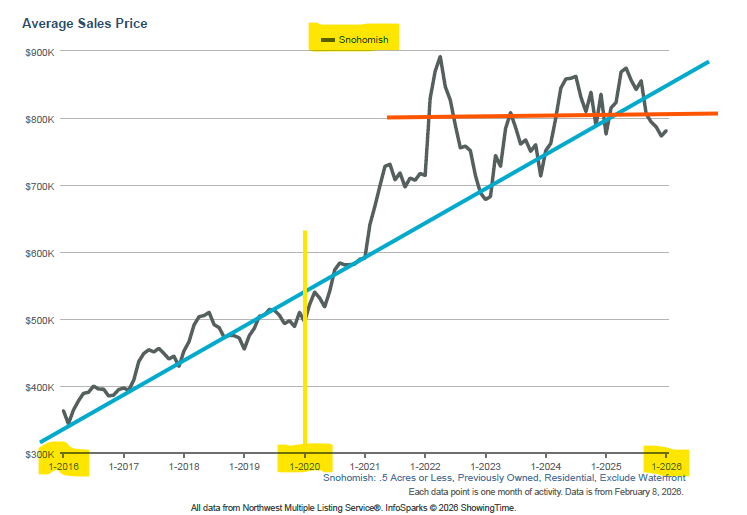

In Snohomish and Skagit, prices edged up slightly compared to April - suggesting continued seller strength. Meanwhile, King County remains higher overall, but prices on average declined slightly ($1.24M to $1.16M) and continuing to be a factor that pushes buyers further out.

Inventory (Homes for Sale):

Homes for sale increased in all three counties with King County leading the way (2,573), and nearly topping the highest inventory levels since July 2022 (2,603). Snohomish County also had a significant increase in inventory, and Skagit only moderate. This trend in growing housing inventory suggests that homes are sitting on the market longer (inventory is accumulating), and trending toward a buyers market. Sellers need to be much more strategic in how they're preparing, marketing, and pricing/incentivizing their homes in this type of market. Buyers have many more options to choose from in this market.

Days on Market:

Homes are sitting on the market longer than a year ago, but still historically low. Skagit County, where homes historically sit on the market much longer than Snohomish and King county, saw a moderate decline from 34 to 28 days. While Snohomish remained the same (13 days) and King Count increased by one day. This reinforces that people are moving toward lower cost areas, while higher cost areas such as King and increasingly so, Snohomish County, are teetering a bit as they continue to deal with affordability dynamics (high home prices and high mortgage rates).

Sale‑to‑List Ratio (original list ask price to final sale price):

Final sale prices for Snohomish and King Counties both declined, but both are still slightly above original asking price. Skagit County had a slight increase in the average final sales price, but still on average, slightly under asking price (1.7%).

May 2024 to May 2025 – The Year‑Long View

Over the past year:

Prices climbed slightly in Snohomish and Skagit, while King County posted a small reduction in home prices from May 2024.

Inventory fluctuated with seasonal dips but remained generally tight - especially when mortgage rates hit peaks early in 2025.

Days on Market fluctuated over the past year which is normal with seasonal fluctuations (increasing in fall and winter and trending down in early spring to early summer).

Sale‑to‑List Ratio was a bit bumpy over the last year, but the overall trend was downward, indicative of increasing inventory and elevated mortgage rates.

Mortgage Rate Check – How It Shapes Trends

30‑Year Fixed Rates are currently around 6.88%, down slightly from a few days ago.

Rates have eased a bit from early‑May highs above 7%, but remain high historically.

Forecasts suggest rates will hover between 6 and 7% through 2025.

What this means:

Higher mortgage rates reduce buying power - meaning buyers can afford less home for the same monthly payment. This is partly why home prices have stabilized, and trending downward in some markets. There are other factors at play as well, such as the increasing cost of living driven from inflation (groceries, fuel, insurance, etc), stagnating wages, etc.

County Spillover Effect

King County’s high prices and tax burden are nudging buyers to Snohomish and Skagit. As house-hunters look north for affordability, these markets see spillover demand—keeping inventory low and supporting price growth.

What It Means for You — Buyer vs. Seller

If You’re Buying:

Get pre‑approved early and lock in a rate before it creeps up.

Be ready to move quickly - less inventory means faster bids, especially in hotter markets such as Skagit County.

Plan ahead - if you’re buying up North, inventory is tighter.

May 2025

Skagit County has 162 homes for sale

Snohomish County has 750 homes for sale

King County has 2,573 homes for sale

If You’re Selling

Price just below market peak to draw multiple offers in a competitive field.

Highlight pricing, condition, or finishes that make your home stand out.

Work with an agent who knows neighborhoods and can leverage local intel.

Looking Ahead

Short term: Expect stable prices, with possible slight decreases and cooler demand as mortgage rates remain elevated and we head deeper into the slower summer months.

Continued tight inventory and King County spillover should keep Snohomish and Skagit markets relatively robust, with stable pricing, and potential for decent price appreciation if we see mortgage rates head downward.

If you want zip-code specific stats or neighborhood-level insights, I’ve got you covered - just reach out! I’m always happy to dig into local data to help you make confident decisions about buying or selling in our area.

Thanks for reading!

Cheers.

-Joe

Comments