September 2025 - Snohomish County Housing Market Update

- Joe Frank

- Sep 8, 2025

- 4 min read

Updated: Oct 5, 2025

This Snohomish County housing data is extracted from the NWMLS and has a one month lag (this is housing data as of 8/31/25).

If you'd like more real-time data for a more specific and accurate analysis relative to your unique property, area, and/or situation, please reach out and I'd be happy to help.

Housing data is extremely location sensitive. Even within a specific County, there are zip codes, communities, and even neighborhoods that defy the numbers discussed below. Of course when you zoom out and look beyond Snohomish and other counties, or even Washington State, you're likely to see dramatic difference from the housing data and trends discussed below.

You can view the latest Snohomish, Skagit, and King County housing data and charts along with other key housing and economic data here: www.joefrankrealtor.com/data

If you’d like to learn about a different area whether within Snohomish or Skagit Counties, or beyond, please contact me at joe.frank@exprealty.com and I’d be happy to provide you such data and an analysis.

The Snohomish County housing market continues to move with a quiet but steady energy as we closed out August 2025 and enter September.

If you're thinking of buying or selling, here's what you need to know—and what it might mean for you.

Snohomish County Housing Update (data through August 2025)

Quick Snapshot (Single-family homes only - no condos, no new construction, 0.5 acre lots or less)

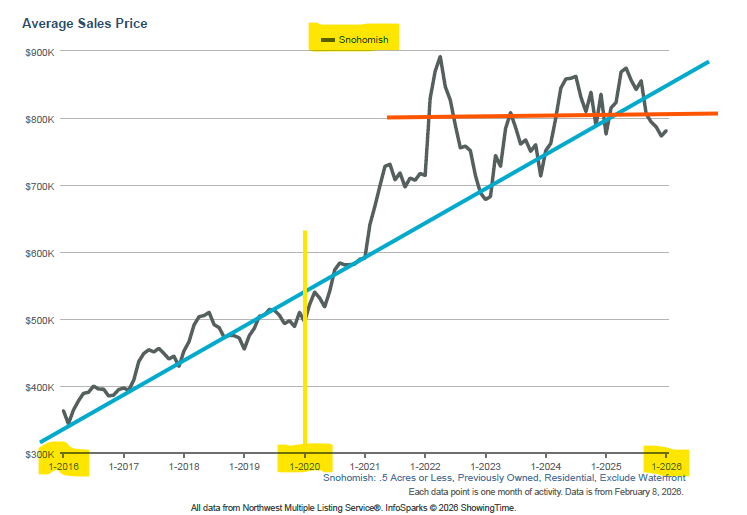

Average Sale Price: $854,000 (up from $841K in July; below May’s $874K peak)

Total Homes for Sale (existing home inventory): 875 (down slightly from 927 in July)

Days on Market: 26 (up from 21 in July; spring low was 13)

Final Sale Price vs. Original List Price: 97.6% (down from 98.4% in July; April high was 101.2%)

What those terms mean (real quick)

Days on Market (DOM): How long a listing takes to go pending. Higher DOM = more time for buyers / more leverage and negotiating power.

Sale-to-Original List Price: Final sale price as a % of the first list price. Example - 100% equates to a home selling for its list price. 97% means a home sold for 3% under its original list price, and 103% meaning it sold for 3% over its original list price.

What’s going on right now?

Late summer is doing what late summer usually does: fewer new listings, slightly lower inventory, and a cooler pace. Prices edged up from July, but buyers are getting more time and a little more negotiating power. Sellers can still win, BUT they absolutely must price for the current market AND present the home and yard well.

Buyers

You have more time. With DOM up to 26 days, you don’t have to jump on the first showing.

Negotiation is back. Homes are selling at 97.6% of original list on average. Ask about credits, rate buydowns, or repairs.

Be strategic. Target homes with 21–30+ DOM or recent price cuts; that’s where concessions are likeliest.

Payment tip. A ½% rate drop can save roughly $150–$250 per month per $500K borrowed (rule of thumb).

Shop the loan. Compare lenders the same day; ask about float-down options in case rates ease after you lock.

Sellers

Price to the last 30–45 days, not to May’s peak. Buyers see the cooler $/SqFt and expect realistic pricing.

Win the first weekend. Great photos, great prep, and a sharp launch capture the biggest pool of buyers.

Plan for credits, not big cuts. A small rate buydown or closing-cost credit can be cheaper than a big price drop and helps the buyer’s monthly payment.

Mind your DOM. If you miss on price, traffic falls off fast. Adjust early rather than chasing the market later.

Condition sells. Turnkey homes still attract strong interest—even when the overall pace cools.

Where could prices go next?

Near term (next 1–3 months):

Expect sideways to slightly softer prices as we move into fall. Well-priced, move-in-ready homes should still sell near ask; others may see 2–3% negotiation off original list.

6–12 months (three simple paths):

Baseline (most likely): Mortgage rates ease gradually; demand improves a bit; prices stabilize with small ups/downs by neighborhood.

Upside: If rates fall faster, more buyers (and some move-up sellers) re-enter. Select pockets see firmer prices and occasional multiple offers.

Downside: If rates pop higher or the job market softens, DOM stretches and price cuts widen—flat to slightly down until affordability improves.

Bottom line: In Snohomish County, micro-markets rule. The outcome on your block can be very different from the county average.

What’s my home worth right now?

That answer depends on zip code, school boundary, condition, and price band. As we head into the fall and winter months, we'll likely see home values stabilize or drop a bit more. It's now more important than ever to price, prepare, and market your home effectively in order to have the best change of hitting your price target.

Want a quick, no-pressure analysis on your unique situation?

I can put together a one-page snapshot with recent comps, DOM bands, price-cut patterns, and payment scenarios at a few rate levels.

Get in touch and I’ll tailor it to your neighborhood and budget.

Thanks for reading!

Cheers!

Joe

You can listen to the podcast for this article below. Please note that the podcast is AI generated from this blog article.

Comments