May 2022 - Snohomish County Real Estate Housing Data

- Joe Frank

- Jun 23, 2022

- 4 min read

The following data and charts represent Monthly data from January 2021 to May 2022.

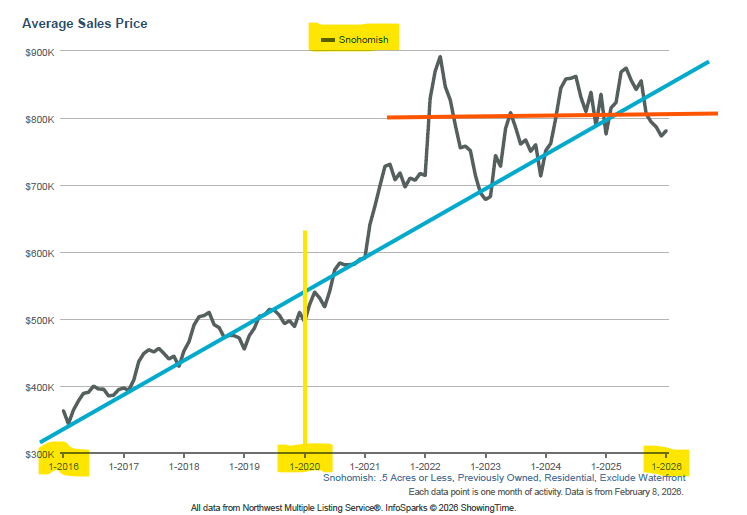

1. Average Sales Price

In Snohomish County the Average Sale Price hit a peak in April 2022. In May of 2022 average home sale prices reflect a decline of 5%. It will be interesting to see what June data shows. Historically, prices trend upward from Spring to late summer. However due to the fast paced mortgage rate increases (see chart 6), this is swiftly and drastically reducing home affordability, and therefore driving home prices down. It’s unclear how long prices may trend down, but interest rates will play a major role. With that in mind, it’s important to keep an eye on the Fed and their interest rate policy (to combat inflation) as this has a direct correlation to mortgage rates.

2. Average Days on Market

This is another key metric to watch in gauging the current housing market, and where it may be headed. It’s a metric that tells us how many days a house is listed for sale (“on the market”) before an offer is accepted. When Days on Market increases, it indicates demand is softening. This in turn may result in less offers, more buyer contingencies, increased supply, and ultimately, decreasing home prices.

3. Quantity of Homes For Sale (in MLS)

This metric shows us how many homes are listed for sale within the MLS. It’s also referred to as housing inventory, as well as supply. You can see from the chart that as of May 2022, the number of homes for sale has dramatically increased from last year, and it really began accelerating at the start of this year which coincides with mortgage rate increases (see chart 6).

4. Average Percent of Last List Price

This chart indicates the amount final sales price of a home over last listed price on the MLS. As you can see, Snohomish County hit a peak in about March of this year at 115%, which means on average, in Snohomish County, homes were selling for 15% above the listed price. So if a Home was listed for sale at $700,000 it actually sold for $805,000. We are now on a downward trend which is indicative of higher mortgage rates and a larger number of homes for sale (increased supply) which drives homes to sit on the market longer.

5. Percent of Active Listings with Price Drops (Redfin)

This chart from Redfin shows the percent of active listings that have incurred price reductions. Price drops occur when a home doesn’t get offers as quickly as expected or needed, and the home owner and agent review the market and seller’s situation to determine if the best option is to reduce the home’s price. It seems that we’re seeing some pretty quick price cuts on relatively newly listed homes. Often times in a normal (and healthy) market, sellers don’t get multiple offers the day a home hits the market, or even a day or a week later. In a historically “normal” housing market, a homemay sit for a week, or two, or three (or even longer) before an offer is received. From my perspective, it seems we’re trending (slowly) back to normalcy, however sellers and agents seemingly are not waiting long enough (in some situations a seller must sell quickly) to get a full price offer. Perhaps real estate agents and home owners/sellers have been conditioned to the market where listed homes receive multiple offers in a matter of days, and for over asking price.

Another possibility is that real estate agents are overvaluing homes when formulating CMA’s and not taking into consideration the current economic environment (inflation, recession concerns, rising rates, increased days on market, and increased housing supply), resulting in homes that are initially priced too high. It may lie somewhere in between cutting home prices too early and listing prices too high to begin with.

6. Mortgage Rates

Mortgage rates have risen aggressively since the end of 2021 which has affected home affordability. We’re now witnessing the impact on home prices in Snohomish County (and elsewhere).

The following trend chart from Mortgage News Daily shows the 30 year fixed mortgage rate from June 2021 to June 2022. You can see that toward the end of December 2021 there was an acceleration in the rise of mortgage rates. Nobody knows how high rates will go and if, or when, they’ll come back down to 3 or 4 percent, so it’s something to monitor as higher rates directly affect home affordability and therefore the housing supply and prices.

Source: Mortgage News Daily

To gain a broader sense on the health of our local housing market and economy I'm sharing unemployment data along with new single family home construction permits . These data points do not update monthly but show signals and trends on the health of the economy, and ultimately the housing market.

Unemployment

This data is provided monthly by the Washington State Employment Security Department, and has a 2 month lag. There is no monthly trend data that I can locate for strictly Snohomish County, so I plan to track and create a trend chart that will be maintained in this blog.

As of April 2022, Snohomish County Unemployment is at 2.3%. Source: esd.wa.gov

New Residential Housing Permits

This data is not provided by county, but rather metropolitan area. In the case of Snohomish County, I’m relying on the “Seattle Metro Area” which is essentially Snohomish, King, and Pierce County data. This data has a two month lag. Residential housing permits authorize new housing units to be built, but does not indicate if construction has started, or whether it will ever start.

Seattle Metro area as of April 2022, new housing permits for Single Family Residential: 646 permits issued. Year to date (Jan to April 2022) there have been 2,652 permits issued. Source: United States Census Bureau

That's A Wrap!

I hope the preceding charts and data provided you with useful information and insight about our local real estate and housing market. Please let me know in the below comments (or email) if this information is helpful and if you’d like to see it monthly. Of course if you have any recommendations on the data and how it’s presented I’d love to hear your thoughts.

Comments