March 2025 - Snohomish County Real Estate Health, Trends & Insights

- Joe Frank

- Apr 12, 2025

- 17 min read

Local Snohomish (and now Skagit) County Zip Code Highlights for March 2025.

This local housing data is extracted from the MLS and has a ONE MONTH lag, so we are looking at data as of 3/31/25. I have access to real-time data if you need a more accurate and specific analysis relative to your unique property, area and/or situation.

Please know that housing data is extremely location sensitive. Even within Snohomish County, there are zip codes, communities, and even neighborhoods that defy the numbers discussed below. Of course when you zoom out and look beyond Snohomish County, or even Washington State, you will likely see dramatic difference from the specific housing data and trends discussed below.

You can view the latest Snohomish County housing data and charts along with other key housing and economic data here: www.joefrankrealtor.com/data

If you’d like to learn about a different area whether within Snohomish County, or beyond, please contact me at joe.frank@exprealty.com and I’d be happy to provide you such data and an analysis.

98012 (Bothell/Mill Creek area)

This zip code saw a surge in supply this spring. New listings nearly doubled (+88%) compared to March 2024, and the number of homes for sale is up almost four-fold year-over-year.

Despite the influx of inventory, demand held strong – the median sales price in 98012 rose about 9% from last year to roughly $1.13 million.

With just ~1.3 months of inventory (up from only 0.4 months a year ago), the market here remains competitive, though buyers now have a bit more selection than last spring.

98208 (South Everett/Silver Lake)

Moderate growth in new listings (+6% year-over-year) kept inventory rising in this area.

Active supply roughly doubled from a year ago (about 1.1 months of inventory now vs. 0.6 months last March).

Strong buyer interest pushed prices significantly higher – the median home price in 98208 jumped 16% year-over-year, reaching approximately $822,000.

Homes are taking longer to sell than they did last spring (about a month on market on average, vs. just over a week a year ago), but well-priced listings are still selling at just above asking price on average.

98290 (Snohomish city & vicinity)

Supply expanded here as well – new listings rose ~27% from a year prior, and inventory is up 58% year-over-year (now roughly 1.6 months’ supply, up from 1.2).

The median sales price for March was about $820,000, up 15% compared to March 2024, indicating solid appreciation.

Notably, fewer homes closed in March than last year (closed sales were down over 30% for the month), and the average time to sell jumped to around two months – a sign that some listings are sitting longer. Even so, price trends suggest that buyer demand is keeping up with the increased supply in the Snohomish (98290) area.

98296 (South Snohomish / Cathcart / Clearview area)

This zip had one of the biggest spikes in activity. New listings more than doubled (+118%) year-over-year, and closed sales also roughly doubled.

Inventory jumped by about big (now ~1.4 months’ supply vs. 1.0 last year).

Interestingly, the median price in 98296 came in about 22% lower than a year ago (around $1.0 million vs. $1.28M last March).

This price drop doesn’t necessarily indicate falling values across the board – it likely reflects a different mix of homes sold (e.g. more mid-priced homes and fewer high-end sales this year). In fact, homes here sold faster on average than last year (about 19 days on market, down from 30 days), showing that buyers quickly absorbed the new inventory, especially at more affordable price points.

Key Takeaway - Snohomish County Real Estate Health

Across these Snohomish County zips, inventory is up notably from last year – giving buyers more options – yet pricing remains resilient or even climbing.

Higher supply hasn’t flipped the market to favor buyers yet, but the days of extreme frenzy have cooled slightly in some areas (e.g. homes taking a bit longer to sell in 98208 and 98290). Sellers in hot areas like 98012 are still seeing strong price gains, while buyers in areas like 98296 have more negotiating power than before.

Overall, these zip code trends illustrate a spring market that's warming up with new listings but still characterized by low inventory and upward pressure on prices.

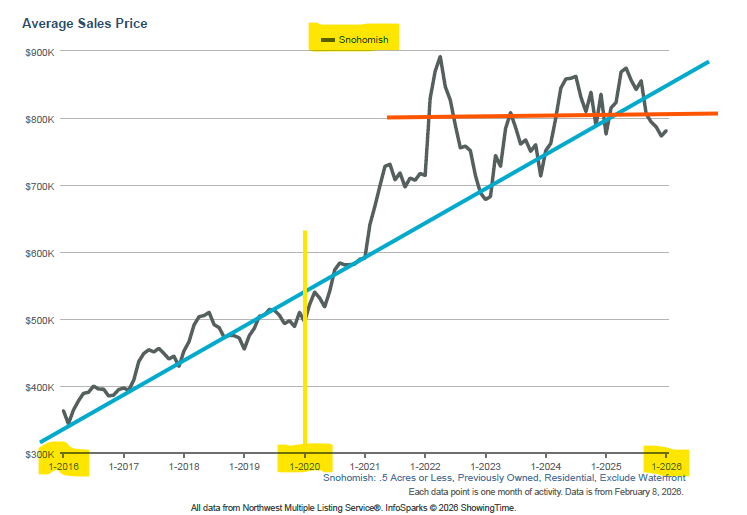

Snohomish County Market Trends

Residential (Single-Family Homes)

Snohomish County as a whole is experiencing a bump in supply this spring, though the market remains undersupplied by historical standards.

In March 2025, new listings were up 20% compared to March 2024, reflecting a much-needed increase in homes coming to market. Buyer activity kept pace – pending sales (homes under contract) rose about 13% year-over-year, and the number of closed sales was roughly flat (just 0.5% higher than last March). Notably, the median sales price for Snohomish County homes ticked up to $786,250, a 3.5% increase from a year ago. This suggests that, despite more supply, prices are still trending upward, albeit at a more moderate rate than the double-digit jumps seen in the frenzied market of a couple years back.

Homes are generally selling a bit slower – averaging about 27 days on market vs. 20 days last March – and sellers are getting about 100.9% of list price on average, versus 102.2% last year (so fewer bidding wars above asking).

Inventory has expanded significantly: at the end of March, Snohomish County had 844 active residential listings, up 67.8% from a year prior. That equates to roughly 1.3 months of inventory, up from only 0.8 months last spring. In fact, Snohomish County’s active supply increase was one of the largest in the region (inventory was 83% higher year-on-year, the biggest jump among major Washington counties).

Bottom line: Snohomish County’s housing market is easing slightly toward balance – buyers have more choice now than last year – yet inventory is still only about a six-week supply, so sellers retain the advantage and home prices continue to edge up.

Condominiums

The condo market in Snohomish County also expanded in March. New condo listings were up ~8% year-over-year, and the active condo inventory nearly doubled (191 listings vs. 104 last March, +83.7%).

Condo sales activity had mixed results: pending sales dipped 14% compared to a year ago, while closed sales actually increased 2.6%. This could indicate some softness in buyer demand for condos relative to supply, or simply timing differences in sales.

The median condo sales price in March was about $505,000, up 3.6% from a year prior. The average condo price was roughly $567k, which is actually a few percent lower than last year’s average – possibly reflecting more affordable units selling.

Condos are taking longer to sell on average (37 days on market vs. 23 days last March), and sellers received about 99.4% of asking price on average (down from 101.4% last year).

In summary, Snohomish County condos are seeing more inventory and milder price gains than the single-family segment, and buyers have gained a bit of leverage compared to last year. Still, with only 1.4 months of condo supply available, condos remain in a seller’s market scenario as well.

Skagit County Market Trends (March 2025)

Neighboring Skagit County also experienced a spring uptick in both activity and inventory, though it’s a smaller market.

Residential

In March 2025, new listings in Skagit County were up 12% from a year ago (159 new listings vs. 142 in March 2024) and buyer demand was strong – pending sales jumped 23% year-over-year.

The number of closed sales rose about 21% compared to last March, indicating a notable increase in market throughput. Homes sold a bit faster last year than this year (49 days on market on average this March, up from 45 days a year ago), but that minor slowing didn’t hinder price growth.

The median sale price for Skagit houses was roughly $623,950, up 9.5% year-over-year. (For context, that median is lower than Snohomish’s, reflecting Skagit’s more rural, affordable profile – but the price growth rate in Skagit outpaced Snohomish this month.)

The average home price surged even more, up 15% to about $739,000, suggesting some higher-end sales boosted the average.

Inventory crept up modestly – Skagit had 199 active listings at month end, 10.6% more than a year ago. However, because sales also rose, the months of inventory actually dipped slightly to about 1.7 months (from 1.8 months last year). In short, Skagit’s housing market remains quite tight. Even with a few more homes on the market, an upswing in buyer demand kept conditions competitive and prices on an upward trajectory.

Overall takeaway for Skagit County

The single-family sector is very robust (more homes selling quickly and at higher prices), whereas the condo segment is tiny and somewhat variable. For most Skagit County buyers and sellers – who deal mainly in residential homes – the market in early 2025 still favors sellers, but conditions are slightly less frenzied than before as inventory slowly increases.

Mortgage Rate Update (April 2025): Stable but Watchful

The national mortgage rate environment in April 2025 adds an important backdrop for buyers and sellers. After the rapid rate climbs of 2022–2023, rates remain elevated but have shown signs of stabilizing in the mid-6% range. As of early April, the average 30-year fixed mortgage rate is around 6.7–6.8% for well-qualified borrowers.

In fact, rates spent most of March fluctuating only slightly and ended the month at about 6.75% on average. This is a bit lower than the peaks reached in late 2023 and January 2025 – for example, the 30-year rate hit a cycle high above 7% in January before easing back down.

While 6.75% is still high compared to the 3 to 4% rates homeowners enjoyed a few years ago, the recent plateauing of rates has been somewhat reassuring for the market. In fact, mortgage applications picked up slightly as borrowers gained confidence that rates weren’t about to spike again immediately.

Where are rates headed?

Many forecasters predict that mortgage rates could gradually trend downward over the course of 2025, potentially approaching the 6% mark by late 2025. However, this outlook comes with a big asterisk: if rates fall, it will likely be because the economy is slowing. As one industry expert noted, “average rates are expected to move closer to 6% in 2025, but the concern is that lower rates could be the result of a deteriorating economy.” (cnet.com). In other words, a recession or softening economy would likely push mortgage rates down (since investors flock to bonds, driving yields down) – but that scenario could also mean weaker buyer confidence or job losses, offsetting some benefits of the lower rates. For now, the Fed is still watching inflation closely, and interest rates are in a bit of a holding pattern.

Impact on buyers

At current rates (~6.75%), affordability is a challenge – monthly mortgage payments are much higher than a few years ago for the same loan amount. Buyers need to budget for these higher financing costs, which can limit how much home they can afford.

The silver lining is that if you lock in a rate now and rates drop later, refinancing could bring relief. Also, the current rate stability has given buyers a chance to adjust – we aren’t seeing the sudden spikes that derail home purchases at the last minute, however this can quickly change, especially with the current tariff war.

Impact on sellers

High rates can shrink the buyer pool somewhat, but demand in our region has persisted thanks to low inventory. Some sellers are holding off listing because they don’t want to give up their ultra-low rate on their current home (a phenomenon often called the “mortgage rate lock-in”).

Those who do decide to sell now are entering a market with fewer competing listings than normal, and a steady rate environment means serious buyers are out shopping, even if their budgets are a bit tighter.

All in all, mortgage rates in spring 2025 are elevated but steady, allowing the housing market to function without the shock of rapid changes – yet everyone is aware that economic shifts in the coming months could send rates moving again, and quite honestly, on a dime!

New 2025 Tariffs and Economic Uncertainty

On the economic front, recently enacted tariffs have introduced a new wrinkle that both buyers and sellers should consider and monitor.

In early April 2025, the U.S. announced a sweeping wave of import tariffs, including a 10% universal import tax on goods from many countries. These tariffs are broad-based – affecting a range of sectors from consumer products and retail goods to industrial materials.

For example, imported items like electronics, appliances, clothing, and automobiles are now subject to the additional 10% tax, which could make these everyday purchases more expensive.

Even building materials are in the crosshairs: tariffs on lumber, aluminum, steel, and other critical inputs could raise construction costs for new homes. This aggressive trade policy shift – described as “the single biggest trade action of our lifetime” by one trade expert (reuters.com) – has injected uncertainty into the economic outlook for 2025.

Inflation

Tariffs act essentially as a tax on imported goods, and companies often pass along those higher costs to consumers. Thus, one immediate concern is upward pressure on inflation. If the cost of a wide array of products (from groceries to iPhones) goes up by 10% due to import taxes, consumers will feel it in their wallets. Higher prices on consumer goods could keep overall inflation higher than it otherwise would be, at least in the short run.

For the housing market, persistent inflation is a double-edged sword: it can lead to higher mortgage rates (since central bankers may hold rates high to fight inflation), and it also erodes consumers’ purchasing power, making it harder to save for down payments or afford monthly payments.

Consumer Spending

With many everyday items potentially getting pricier, households may start to pull back on spending.

If you’re paying more for gas, groceries, or a new washing machine, you might postpone other expenditures. Big-ticket purchases often take a hit when uncertainty rises – and a home is the biggest-ticket item of all. The tariffs have also caused some pretty severe turbulence in the stock market, which can dent consumer confidence and wealth (also known as the "wealth effect"). When people feel financially less secure or see their 401(k) values fall, they tend to become more cautious about major investments like buying a home.

So far, consumer spending nationally has been resilient, but these new tariffs add risk to that outlook. In our local market, we might see some buyers becoming more budget-conscious or delaying purchase decisions until they get clarity on the economy.

Employment

Tariffs on this scale also raise concerns about jobs and economic growth. Trade wars can lead to retaliation from other countries, potentially hurting U.S. export industries (think agriculture or aerospace – important sectors in Washington state).

Companies facing higher costs for imported components might slow production or cut expenses elsewhere (possibly including hiring). The tariff rollout has definitely stoked recession fears.

While a full-blown recession is not a certainty, many economists warn that aggressive tariffs increase the risk. If an economic slowdown hits, the job market could soften – layoffs or hiring freezes in affected industries would directly impact some potential home buyers (who may then postpone homeownership plans).

For now, unemployment remains low, but this will be a trend to watch. Real estate activity tends to cool if local unemployment rises, as fewer people feel secure enough to make a major purchase.

On the flip side, if tariffs eventually may lead to more domestic manufacturing jobs (a long-term political goal of such measures), that could bolster local employment – but any such benefit is uncertain a ways out as it takes time to build facilities, buy equipment, hire, and train workers.

Mortgage Rates

The tariff situation brings a mix of potential impacts to mortgage rates. In the near term, the turbulence and uncertainty have actually caused a flight to safety among investors – money flowing into U.S. Treasury bonds, which has nudged down bond yields and subsequently, mortgage rates. (We saw hints of this with mortgage rates dipping in early April on the tariff news.)

However, looking ahead, if tariffs keep inflation higher, the Federal Reserve may feel pressure to maintain higher interest rates for longer, which could prop up mortgage rates or at least prevent them from falling. There’s also the broader question of economic growth: if the tariffs set off a trade war that slows the economy, the Fed might eventually cut rates to stimulate growth, which would pull mortgage rates down.

In essence, tariffs add to the uncertainty around interest rates. As one mortgage expert put it, “Nobody knows what tomorrow holds when it comes to tariffs or government policies, and thus mortgage rates are in a holding pattern of sorts.” (cnet.com)

We could see rates rise if inflation heats up, or fall if the economy stalls – or even do a bit of both in the volatility that may lie ahead.

In summary, the new 2025 tariffs are something of a wild card. They directly increase costs in many sectors of the economy (including homebuilding materials), which could contribute to higher inflation and squeeze consumers. They’ve also rattled financial markets and added to recession anxieties.

For our Snohomish and Skagit housing markets, this means we’re keeping an eye on factors like interest rates, buyer confidence, and local employment in industries that could be affected.

So far, the housing fundamentals (low inventory, solid demand) are unchanged – but buyers and sellers should stay informed, as broader economic shifts could tip the balance in the real estate market as the year progresses.

Uncertainty around tariffs continues to persist, even as I write this blog article (April 10th). The tariff battle now seems to be primarily focused between the US and China, which depending upon how this goes and for how long, could have a detrimental impact on the economy, and potentially housing and mortgage rates. Nonetheless, nobody knows, which is why the stock and bond markets are whipsawing up and down over the last few weeks. Once we get more clarity on tariffs, markets should stabilize and we'll have a clearer picture on our local housing markets and mortgage rates.

So, You're Probably Asking - Is Now a Good Time to Buy or Sell...Or Wait?

With all this economic uncertainty (tariffs, inflation risk, and fluctuating rates) layered on top of our local market conditions, many readers are likely asking: Should I buy or sell now, or hold off? The honest answer is that it depends on your personal situation – but I can offer some balanced insights for both sides:

For Home Buyers

If you’re in a stable position financially and find a home that fits your needs, buying sooner rather than later can make sense, even in this uncertain climate, and especially if you plan to be there 5 or more years.

Why buy now? Home prices in Snohomish and Skagit have been trending upward this year, and demand still exceeds supply in most areas – meaning waiting could result in higher prices down the road. Also, while current mortgage rates around ~6.7% are not cheap, they are off their peak highs, and you always have the option to refinance later if rates drop. Buying now secures you a home and fixes your housing cost (at least the principal and interest portion) – providing stability in an inflationary environment. Additionally, we’re seeing a bit more inventory now than last year, which gives you a better chance to negotiate or at least avoid bidding wars. That said, why might some buyers wait? If you believe that the economy might weaken, you could hope for lower mortgage rates or even a dip in home prices in the future. It’s possible that if a recession hits, home price appreciation will flatten or even reverse slightly in some areas, and financing could become cheaper. Waiting could also give you more time to save up for a larger down payment. The risk of waiting is that if the economy doesn’t cool significantly, you might face even higher housing costs: prices might continue to climb, and any rate relief could spur a surge of buyer competition (erasing the benefit of the lower rate). In short, today’s buyers have more negotiating power than they’ve had in years – use it to your advantage. Focus on homes that are fairly priced (some sellers are still adjusting to the new normal), don’t be afraid to negotiate on inspection items or price, and keep a long-term perspective. If you plan to stay in the home for several years, a small market fluctuation next year becomes less important than locking in a home you love and can afford.

For Home Sellers

It’s still a favorable market for sellers, but the conditions are gradually changing, so strategy is key.

Why sell now? We are in a traditionally active spring market with serious buyer demand in Snohomish and Skagit Counties – many homes (especially in popular price ranges) are still receiving multiple offers or selling quickly if priced well. The data shows prices are generally higher now than a year ago, so you can likely sell at a strong price. Also, with inventory still historically low, you face less competition from other sellers; your home stands out more to buyers since there aren’t many alternatives.

Given the economic uncertainties, there’s a case for “sooner is safer” – selling now locks in your gains at near record-high values, whereas waiting a year introduces the risk that home prices could stagnate or soften if the economy or rates take a turn for the worse.

Why might some sellers wait? If you’re not in a hurry, you might bet on the idea that mortgage rates will fall later in 2025, bringing out more buyers and potentially allowing you to fetch an even higher price. A more robust economy (if things stabilize) could boost buyer confidence and budgets.

Additionally, some sellers simply can’t find their next home yet – if you sell, you become a buyer in the same tight market, which is a challenge. Those with a super low current mortgage rate may also be reluctant to give that up (if you sell and buy another home, you’d likely finance at today’s higher rates).

The risk of waiting is that we don’t know how long this window of relatively strong seller advantage will last. By next year, we could see more people listing their homes (in response to rate improvements or other factors), resulting in higher inventory that gives buyers more choices and more leverage.

Further, if the economy does tip toward recession, buyer demand could cool and price growth could slow. For sellers who do move forward now, a couple tips: price your home realistically (the days of wild overbids are fading, and today’s buyers are price-sensitive with rates so high), and make sure your home is in its best shape to attract offers. Well-prepared, well-priced homes are still selling briskly – often in just a few weeks – whereas overpricing could lead to your listing sitting longer as buyers have become more discerning.

Bottom Line

There is no one-size-fits-all answer. If you’re buying, focus on your needs and budget – trying to time the absolute bottom of the rate or price cycle is very difficult.

If you find the right home, this market (with more listings and negotiability than last year) offers an opportunity to make a move. If you’re selling, the market is still in your favor today, but you’ll want to keep an eye on economic cues.

I recommend staying neutral and informed: watch how mortgage rates respond in the coming months to the tariff situation and Fed decisions, and monitor local inventory levels.

It’s wise for both buyers and sellers to have a plan B. Buyers should get pre-approved and run scenarios for different rates (can you afford the payment if rates tick up another half-percent?). Sellers should discuss with their agent how to navigate pricing if the market shifts (for example, be prepared for slightly longer time to sell and have a plan if your home doesn’t garner offers in the first few weeks).

Ultimately, real estate decisions should align with your personal timeline and goals.

If you need to move due to life circumstances (job change, growing family, downsizing, etc.), don’t be paralyzed by broader uncertainty – just go in with eyes open. Both counties are still seeing healthy activity. Buying or selling in an uncertain economy means partnering with a knowledgeable local agent, staying on top of market data (like the trends we outlined above), and being ready to act when the time is right for you.

Whether you choose to act now or wait, remember that real estate is a long-term investment. Snohomish and Skagit County communities have historically shown resilience and continued growth, so making a well-informed move in this market can pay off in the long run.

Stay safe, stay informed, and don’t hesitate to seek professional guidance tailored to your situation – and you’ll be well positioned to navigate whatever the 2025 market brings.

As always, whether you’re buying or selling, I’m here to guide you through the Snohomish County housing market. My goal is to help you make informed decisions, get the best deal possible, and feel confident every step of the way. Let’s make your next move a smart one!

Please remember, I’m providing opinions on Snohomish and Skagit County housing data only. Housing markets vary greatly from one market to the next, and even from neighborhood to neighborhood.

If you'd like to learn more about Snohomish or Skagit County housing markets - whether by zip code, community, or neighborhood - or if you're curious about other areas or even states, and the best times to buy, sell, or rent, let's connect!

I love talking real estate, so I'm always happy to discuss anything on your mind! And of course if you're not already working with a Real Estate Agent, I'd love to assist you in your real estate journey.

To view the Snohomish County housing trends, mortgage rates, and other data that I used for this market update, please visit: Joe Frank Realtor Data

Thank you for taking the time to read this article!

If you have any questions or comments, please feel free to leave below, email, text, or find me on social.

Cheers!

-Joe

Comments