July 2022 - Snohomish County Real Estate Housing Data

- Joe Frank

- Aug 10, 2022

- 5 min read

Updated: Aug 15, 2022

The following data and charts represent Monthly data from January 2021 to July 2022.

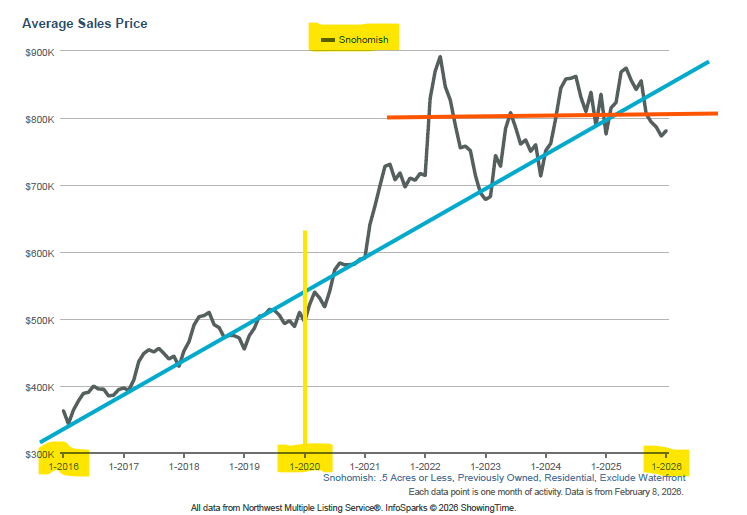

1. Average Sales Price

In Snohomish County the Average Sale Price hit a peak in April 2022 ($882,000). In May of 2022 the average home sale prices reflected a decline of 5% ($839,000). The June average sales price declined 7% from the April high to an average sales price of $818,000. The trend continues as expected for July 2022 with an average sales price of $780,000 which is 11.5% below the April high!

Historically, home prices trend upward from spring to mid-summer, however due to the fast paced mortgage rate increases (see chart 6) home affordability was abruptly impacted. This in turn is driving the price decreases we're seeing from April 2022 to July 2022 (as the Fed was hoping).

I would expect this downward home price trend to continue as homes are still relatively unaffordable for the average worker / salary when financed with a mortgage. This is more of a correction, and not a crash.

Until the fed stabilizes or lowers the fed rate and mortgage rates react accordingly we're likely to see continued downward pressure on home prices.

2. Average Days on Market

This is another key metric to watch in gauging the current housing market, and where it may be headed. It indicates how many days a house is listed for sale (“on the market”) before an offer is accepted. When Days on Market increases, it indicates home buying demand is softening. This in turn may result in less offers, more buyer contingencies, increased supply, and ultimately, decreasing home prices.

3. Quantity of Homes For Sale (in MLS)

This metric tells us how many homes are listed for sale within the MLS. It’s also referred to as housing inventory or supply. You can see from the chart that as of May 2022, the number of homes for sale has dramatically increased from last year, and it really began accelerating at the start of this year which coincides with mortgage rate increases (see chart 6).

As of July (2022) there are 1,300 homes listed for sale. This is from a 2021 low of 186 (January) - Nearly a 600% increase - WOW!

4. New Listings

The New Listings data (I added for the first time this month) can help shed some light on the health of our local housing market and if we're trending back toward a more healthy and balanced market. In June new listings were 1,269. In July they were 1,090.

When viewed in conjunction with the Quantity of Homes For Sale graph (#3), it's indicating the increased number of homes for sale is due to inventory accumulation (houses sitting on the market for longer - see also graph #2, Average Days on Market) and NOT more people listing their homes for sale.

New listings is also influenced by the time of year - the peak season to list a home for sale is normally from approximate April to July. Further, if you're a home seller, and you don't have to sell your home, is this the type of market you would want to sell in? There's much uncertainty and prices are trending downward, so the market psychological factor may be coming into play as well.

5. Average Percent of Last List Price

This chart indicates the amount final sales price of a home over last listed price on the MLS. As you can see, Snohomish County hit a peak in about March of this year at 115%, which means on average, in Snohomish County, homes were selling for 15% above the listed price. So if a Home was listed for sale at $700,000 it actually sold for $805,000. We are now on a downward trend which is indicative of higher mortgage rates and a larger number of homes for sale (increased supply) which drives homes to sit on the market longer.

For July 2022, on average homes are selling for the list price (often times after a price cut has occurred).

6. Showing Time Index (ShowingTime.com)

Data from ShowingTime indicates the number of people viewing homes for sale. Below chart is the West region only, but you can see it's down dramatically from the highs. It's also dropped the most amongst all the US regions. This further shows that buyer interest has waned likely due to home affordability compared to average salaries.

Full data details for all regions of US available here from ShowingTime.com

7. Percent of Active Listings with Price Drops (Redfin.com)

This chart from Redfin shows the percent of active listings that have incurred price reductions. Price drops happen when a home doesn’t get offers as quickly as expected or needed, and the home owner and agent review the market and seller’s situation to determine if the best option is to reduce the home’s price.

Price drops (or cuts) have been up and down over the last few months. Through the end of July 2022 for all current homes listed for sale, 13% have had price reductions. This is by far the highest amount in at least the last few years.

8. Mortgage Rates

Mortgage rates have risen aggressively since the end of 2021 which has affected home affordability. We’re now witnessing the impact on home prices in Snohomish County (and elsewhere).

The following trend chart from Mortgage News Daily shows the 30 year fixed mortgage rate from July 2021 to July 2022. You can see that toward the end of December 2021 there was an acceleration in the rise of mortgage rates.

Rates have been bouncing around a bit over the last couple months hitting a high of nearly 6.5%. They're now back to around 5%. It's unclear if or when they’ll trend back down to 3 or 4 percent. Higher rates directly affect home affordability and therefore the housing supply and prices so a very important number to keep an eye on if you're looking to buy, sell, or refinance.

Source: Mortgage News Daily

To gain a broader sense on the health of our local housing market and economy I'm sharing unemployment data along with new single family home construction permits . These data points can help show signals and trends on the health of the economy, and ultimately the housing market.

Unemployment

This data is provided monthly by the Washington State Employment Security Department, and has a 2 month lag. There is no monthly trend data that I can locate for strictly Snohomish County, so I plan to track and create a trend chart that will be maintained in this blog.

As of June 2022, Snohomish County Unemployment was at 3.1% (May 2022 = 2.9%, April 2022 = 2.3%). Source: esd.wa.gov

New Residential Housing Permits

This data is not provided by county, but rather metropolitan area. In the case of Snohomish County, I’m relying on the “Seattle Metro Area” which is essentially Snohomish, King, and Pierce County data. This data has a two month lag. Residential housing permits authorize new housing units to be built, but does not indicate if construction has started, or whether it will ever start.

Seattle Metro area as of June 2022, new housing permits for Single Family Residential: 649 permits issued. Year to date (Jan to June 2022) there have been 4,070 permits issued. Total permits issued to date is the 28th highest compared to the other 384 major cities and metro areas monitored. Source: United States Census Bureau

That's A Wrap!

I hope these charts (and my opinions) provide you with some useful information and insight about our local real estate market. Please let me know in the below comments (or email) if this information is helpful and if you’d like to see it continue monthly.

Of course if you have any feedback on the data or formatting I’d love to hear your thoughts. I can also reach out beyond Snohomish County if you have a local area or even a different state you'd like similar data on.

Comments