December 2022 - Snohomish County Real Estate Housing Data

- Joe Frank

- Jan 13, 2023

- 9 min read

The following data and charts represent monthly data from January 2019 to December 2022. The analysis is focused mainly on trends from April 2022 to the current month.

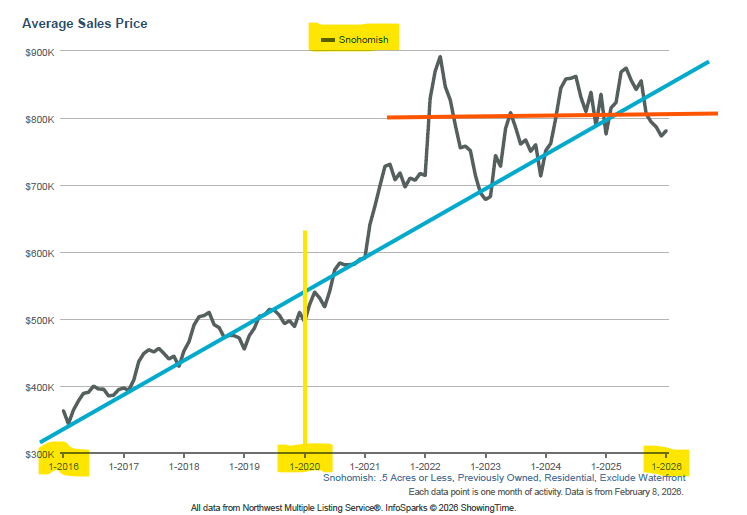

1. Average Sales Price

In Snohomish County the Average Sale Price hit a peak in April 2022 at $882,000. The trend continued as expected for July 2022 with an average sales price of $780,000 which was 11.5% below the April high. The September 2022 average sales price ticked up slightly from August to $749,000.

For December, the downward trend continues with an average sales price of $678,000. This is down from November's average sales price of $703,000. November and December are historically very slow and prices tend to decline. However, the downward trend is still intact.

As mentioned in previous posts, I expect the downward price price pressure to sustain as homes are still unaffordable for the average worker / salary in the Snohomish area (and beyond) considering the average sale prices, mortgage rates, and people's earnings. We'll need mortgage rates and/or employee earnings to increase to stop the downward pressure on home prices.

The Fed has signaled that their rate of interest raising may slow moving forward (based on the current economic environment and facts/data). There is still concern at the Fed of sustained inflation, thus the Fed funds rate will continue to increase (thought perhaps by less) until the they're satisfied they've inflicted enough pain on the economy (higher unemployment and lower / affordable home prices).

2. Average Days on Market

Average Days on Market indicates how many days a house is listed for sale (“on the market”) before an offer is accepted. When Days on Market increases, it indicates home buying demand is softening. This normally result in less offers, more buyer contingencies, increased housing supply, and ultimately, decreasing home prices.

Looking back to January 2019, Average Days on Market was over 40. This was considered to be a healthier and more balanced market. If you're looking to buy, you should be rooting for the below trend to sustain between 30 and 40. For December 2022, we're back to that early 2019 sweet spot where more leverage lies with the buyer. Seasonality is no doubt at play, as December is a very slow month for home sales. It will be interesting if this continues into February and March when home sales tend to increase.

3. Pending Sales

For this month and moving forward, I'll be including Pending Sales for Snohomish County.

Pending Sales can be a leading indicator of what home sales will be within the next 30 to 60 days (the average time to close on a home once an offer has been accepted). Not all pending sales will close, however on average, 80% make it through closing and become a finalized home sale.

December 2022 Pending Sales for Snohomish County was 294, this is the lowest pending sale amount since prior to 2019. As can be seen from the chart, sale activity is severely impacted by the season - consistently hitting lows in December and January. Pending Sales should begin trending upward in January, and for sure by February - however it will be interesting if this holds true in the current economic climate and housing affordability situation.

4. Quantity of Homes For Sale (in MLS)

This metric indicates how many homes are listed for sale within the MLS in Snohomish County. It’s also referred to as housing inventory or supply. You can see from the chart that as of approximately May 2022, the number of homes for sale has dramatically increased from last year. The acceleration coincides with mortgage rate increases (see chart 8).

However, we peaked in July 2022 with 1,200 homes for sale on the MLS. For the current month, December, we've continued the downward trend to 474. The quantity of homes listed for sale is likely due to (1) seasonality and (2) the mortgage lock-in effect. We should see the quantity of homes for sale trend upward as we move out of the holiday season.

5. New Listings

The New Listings data can help shed light on the health of our local housing market and whether we're trending toward a more healthy and balanced market relative to housing inventory / supply.

New listings is also influenced by the time of year - the peak season to list a home for sale is generally from about April to June which is clearly evident on the below New Listings chart. For December, we saw another dramatic drop to 200. November dropped to 326 and October was at 548. There is seasonality at play here, amongst other things such as home owners (potential sellers) just not wanting to enter this market due to lack of inventory / options and high mortgage rates.

If you're a home seller, and you don't need to sell your home, is this the type of market you would want to sell in? People who sell normally need to buy another home. With total housing/ownership costs so high, many would-be sellers are waiting on the sidelines to see what mortgage rates do in this new year. (see also the mortgage rate lock-in effect)

6. Average Percent of Last List Price

This chart indicates the final sales price of a home over or under the original list price on the MLS. As you can see, Snohomish County hit a peak in March of this year at 115%. This means, on average, in Snohomish County, homes were selling for 15% above the listed price. Example: A home was listed for sale at $700,000 and sold for $805,000 - WOW! Now that was an unhealthy market, at least for home buyers, and the market could not / would not sustain it.

The downward trend continues, driven due to the higher mortgage rates and affordability issues.

For October 2022 in Snohomish County, on average, homes sold for under list price at 95.4%, November was 95.3% and December continues the trend at 94.2%. We are now at levels under January 2019 (pre-Covid).

Home prices are still considerably higher than they were in 2019, so this is another indication of our housing affordability dilemma - with the high mortgage rates and still historically high home prices, the average person or family will need mortgage rates and/or home prices to fall further. See Section 8 below for more on Housing Affordability.

7. Average Shows per Listing

The average number of people physically visiting and viewing homes for sale. The numbers are down dramatically from the highs of 2020, 2021 and early 2022.

Since fall of 2022, we've been hovering right between 6 and 7 views on average per home.

This data illustrates that buyer interest has waned due to home affordability. Why go look if you can't afford the home? As we make our way out of the holidays and winter months, this number should begin to trend upward.

Further house showing data details for all regions of US available here from ShowingTime.com

8. Housing Affordability - Snohomish County

Housing Affordability has been decreasing since the start of 2021. Affordability has worsened recently due to continued high home prices coupled with mortgage interest rates that have doubled from the lows in 2020 and 2021.

The Housing Affordability Index (HAI) is updated quarterly and uses three key variables:

Median Home Prices

Median Household Income

Mortgage payment Cost (and assumes a 20% down payment).

Per the AWB Institute, the HAI is calculated by the Washington Center for Real Estate Research (WCRER) at the University of Washington. The HAI helps illustrate the ability (or inability) of middle-income households to make a mortgage payment on a median priced home.

"Affordable" in the space of this index equates to a household not paying more that 25% of their income toward the mortgage (principal and interest only).

A Housing Affordability Index of 100 is considered "affordable" (and a mortgage payment is exactly 25% of income). Below 100 is considered less affordable (or not affordable as you sink toward 0). Above 100 is considered more affordable.

The latest data from Quarter 3 of 2022 shows a slight improvement in home affordability within Snohomish County (and WA State). This can likely be attributed to decreasing home prices, and perhaps even to growing wages.

Last Updated December 2022. Source: AWB Institute

9. Mortgage Rates

Mortgage rates have risen aggressively since the end of 2021 (and even looking back to January 2019). This has significantly affected home affordability due to low housing supply and home prices that remain high, coupled with these rising mortgage rates.

The following trend chart from Mortgage News Daily shows the 30 year fixed mortgage rate from January 2019 to early January 2023.

Elevated rates have been bouncing around the last several months hitting a high of 7.35% October 20th. The 7% rates were the highest in 20 years! Fortunately we've trended down and over the last month have been in the low to mid-6% range.

It's not known at this point when (or if) rates will trend back down to 3 or 4 percent (5% actually sounds pretty good now!). Much will depend on inflation and the Fed's action to battle it with the Federal Funds Rate and how the bond and mortgage markets respond.

Higher mortgage interest rates directly affect home affordability and therefore housing supply and prices - no doubt a very important metric to keep an eye on if looking to buy, sell, or refinance.

Source: Mortgage News Daily

To gain a broader sense on the health of our local housing market and economy, following is some data and perspective on unemployment data along with new single family home construction permits. Such data can show signals and trends on the health of the economy, and ultimately the housing market.

Unemployment

This data is provided monthly by the Washington State Employment Security Department, and has a two month lag. There is no monthly trend data that I can locate for strictly Snohomish County, so I plan to track and create a trend chart that will be maintained in this blog.

Since April 2022 the unemployment increased, and then stabilized in September and October at 3.3%. For the most current data, November, the unemployment rate ticked down slightly to 3.1%. According to the Fed, they want to see the national unemployment rate to reach at least 4%, as they feel this will help to slow the economy and begin curbing inflation.

As of November 2022, Snohomish County Unemployment was at 3.1%

October 2022 = 3.3%, September 2022 = 3.3%, August 2022 = 3.4%, July 2022 = 3.3%, June 2022 = 3.1%, May 2022 = 2.9%, April 2022 = 2.3%)

Source: esd.wa.gov

New Residential Housing Permits

This data is not provided by county, but rather metropolitan area. In the case of Snohomish County, I’m relying on the “Seattle Metro Area” which is Snohomish, King, and Pierce County data. This data has a two month lag. Residential housing permits authorize new housing units to be built, but does not indicate if construction has started, or whether it will ever start, or complete (see below for a national and regional perspective on "Starts" and "Completions").

Data from the US Census Bureau has a two month lag.

Seattle Metro area as of November 2022, new housing permits for Single Family Residential (this is 1 unit, also denoted as "SFR"): 357 permits issued (October 2022 = 427, September 2022 = 459, August 2022 = 611, July 2022 = 564, June 2022 = 649).

Year to date there have been 6,667 SFR permits issued. Total SFR permits issued for Seattle Metro area through October 2022 is the 30th highest (was the 29th as of October 2022) compared to the other 384 major cities and metro areas monitored.

The top US market for the most New Residential Housing Permits (1 unit) in November 2022 is the Houston-The Woodlands-Sugar Land, TX metro area with 2,748 new housing permits.

For national and regional data and trends on Housing Permits, Starts, and Completions, check out this summary from the US Census Bureau on Monthly New Residential Construction. Source: United States Census Bureau

Additional Reading

For additional reading and market insight, check out the following resources. The data is national, and not localized to the Seattle Metro area. Nonetheless, this is great information to consider in a comprehensive analysis to gain a better understanding of the current, and future health of housing markets - locally, regionally, and nationally.

Home Mortgage Application (and refinance) data. This weekly survey data from the Mortgage Bankers Association (MBA) provides a forward looking indicator on the housing market by examining the number of people applying for home mortgage loans. The numbers are released weekly on Wednesday morning. Tip: Scroll down about halfway on the Mortgage Application Survey page to find the current, as well as previous releases.

NAHB / Wells Fargo Housing Market Index (HMI) is a monthly survey based on responses from NAHB member home builders focused on new single-family residential homes. The survey solicits builders' sentiment on the current housing market, as well as their take on the single family housing market looking outward six months. The survey also provides home traffic numbers. The data provides both a national and regional breakout.

That's A Wrap!

I hope this monthly snapshot provides some helpful and relevant information and opinion about our local Snohomish County real estate market and economy.

Please let me know in the below comments (or email) if this information is helpful and if you’d like to continue to see it monthly.

If you have any feedback I’d love to hear your thoughts. For those interested, I can also pull data beyond Snohomish County, or drill down by zip code or even neighborhood if you're looking for additional or more specific data.

Thank you for taking the time to read!

Cheers!

-Joe

Comments