January 2025 - Snohomish County Real Estate Health, Trends & Insights

- Joe Frank

- Jan 14, 2025

- 5 min read

The following January 2025 analysis is for Snohomish County (WA State). Housing data used for my analysis is relative to previously owned, single family homes (no condos), on a 1/2 acre lot or less.

This MLS data has a ONE MONTH lag, so we are looking at data as of 12/31/24. I have access to real-time data if you need a more accurate and specific analysis relative to your unique property, area and/or situation.

Also, please note that housing data is extremely location sensitive. Even within Snohomish County, there are zip codes, communities, and even neighborhoods that defy the numbers discussed below. Of course when you zoom out and look beyond Snohomish County, or even Washington State, you will likely see dramatic difference from the specific housing data and trends discussed below.

You can view the latest Snohomish County housing data and charts along with other key housing and economic data here: www.joefrankrealtor.com/data

If you’d like to learn about a different area whether within Snohomish County, or beyond, please contact me at joe.frank@exprealty.com and I’d be happy to provide you such data and an analysis.

Snohomish County Real Estate Market Overview

The Snohomish County real estate market is navigating some interesting shifts as we move into 2025.

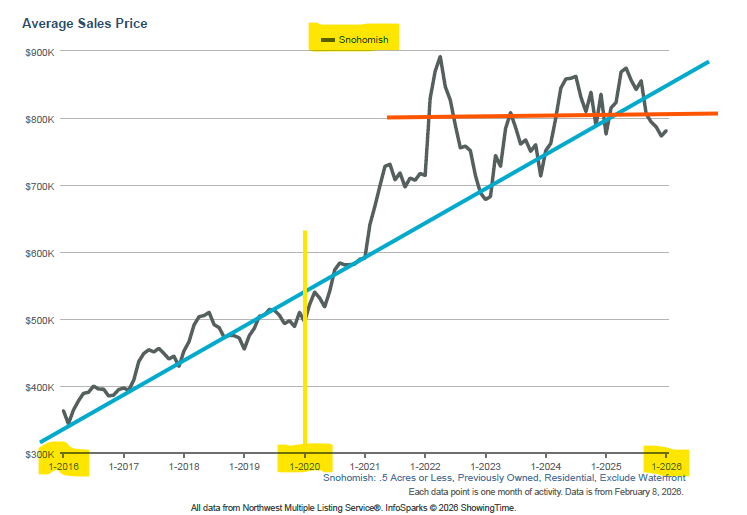

Over the past year, home prices have remained relatively stable, with the average price now sitting at about $835K, a sizeable increase from the same time last year ($735K) and a significant jump from three years ago, when the average home price was closer to $715K.

This steady growth underscores the lasting demand for homes in the area, even as higher mortgage rates have tempered buyer enthusiasm.

Homes Taking Longer to Sell

One noticeable trend is the increasing time it’s taking to sell a home. Currently, homes are spending about 31days on the market, equivalent to the 32 day average from January 2024. Compare this to the red-hot market of January 2022, when homes were being snapped up in 11 days on average, and you can see how buyer behavior has shifted.

Lack of home affordability driven from lingering high mortgage rates along with limited housing supply are making buyers much more cautious and deliberate when it comes to searching for homes and making purchases.

Inventory Levels: A Slow Recovery

Inventory levels are another key factor to watch. There are 266 homes on the market in Snohomish County, a sizeable increase compared to last year but still below pre-pandemic levels.

While this slow growth in inventory is good news for buyers who have more options, it’s still a far cry from the 1,088 homes available back in July 2022.

At the same time, new listings (167) have steadily decreased since May (761). This steadily decline is the result of the seasonality associated with the real estate market as well as hesitation among sellers likely due to economic uncertainty, as many homeowners are reluctant to sell and risk locking in a higher mortgage rate on their next property, especially as mortgage rates have risen back up to over 7% recently and the Fed is signaling they may not cut the Fed Rate as much as originally anticipated.

Negotiating Power Shifts to Buyers

Another sign of a shifting market is how much homes are selling for compared to their original list price. On average, homes are now selling for about 98% of the original asking price, which is right about where it was last year as this time (97.6%). We peaked last year in April at 103.9% which is much better (for buyers) than the peak of 115% set in March of 2022.

Generally speaking, buyers have more room to negotiate, and sellers are adjusting their expectations accordingly during fall and winter months. The momentum will likely shift in a month or two.

Buyer Caution Reflects in Showings

Interestingly, it now takes around 18 showings for a home to go pending, which is about the average over the last two years and up from the lows of 12 in July 2022.

This reflects how today’s buyers are taking more time and thoughtfully weighing their options before committing, likely due to higher borrowing costs, overall rising costs of ownership (and life), and economic caution.

What’s Ahead for the Next Six Months?

Looking ahead to the next six months, mortgage rates will continue to play a pivotal role. With rates hovering around 7%, affordability remains a challenge for most buyers. While the Federal Reserve is lowering the Fed Funds Rate (which will eventually translate to lower mortgage rates), any reductions are expected to be modest and gradual, which means affordability could be a continued challenge and home demand will likely remain somewhat subdued which should drive home prices to stabilize, and potentially even slightly decrease.

Broader Policies and Market Dynamics

On a broader scale, national policies could also influence the local market. For instance, tariffs or stricter immigration laws could increase labor and material costs, potentially slowing new home construction. These factors, combined with persistently low inventory, suggest that prices in Snohomish County are unlikely to drop significantly, even if buyer activity slows.

Conclusion: A Market in Recalibration

In summary, Snohomish County’s housing market is in a phase of recalibration. While higher mortgage rates and cautious buyers are cooling some of the frenzy we saw in previous years, the fundamental imbalance between supply and demand is keeping prices steady.

As we enter 2025, it will be fascinating to watch how these dynamics unfold, especially if interest rates begin to ease later this year. For now, sellers should remain realistic about pricing, and buyers might find opportunities to negotiate as they navigate this more measured market.

Either way, Snohomish County remains a highly desirable area, and the long-term value of homes here is strong.

As always, whether you’re buying or selling, I’m here to guide you through the Snohomish County housing market. My goal is to help you make informed decisions, get the best deal possible, and feel confident every step of the way. Let’s make your next move a smart one!

Please remember, I’m providing opinions on Snohomish County housing data only. Housing markets vary greatly from one market to the next, and even from neighborhood to neighborhood.

If you'd like to learn more about the Snohomish County housing market - whether by zip code, community, or neighborhood - or if you're curious about other counties, cities, or states, and the best times to buy, sell, or rent, please contact me.

I love talking real estate, so always happy to discuss with you (of course at no cost or obligation)!

To view the Snohomish County housing trends, mortgage rates, and other data that I used for this market update, please visit: Joe Frank Realtor Data

Thank you for taking the time to read this article!

And as always, if you have any questions or comments, please feel free to leave below, email, text, or find me on social.

Cheers!

-Joe

Listen to the podcast for this blog article:

note: this podcast is AI created from this blog article.

Comments