December 2024 - Snohomish County Real Estate Health, Trends & Insights

- Joe Frank

- Dec 8, 2024

- 5 min read

Updated: Dec 10, 2024

The following December 2024 analysis is for Snohomish County (WA State). Housing data used for my analysis is relative to previously owned, single family homes (no condos), on a 1/2 acre lot or less.

This MLS data has a ONE MONTH lag, so we are looking at data as of 11/30/24. I have access to real-time data if you need a more accurate and specific analysis relative to your unique property, area and/or situation.

Also, please note that housing data is extremely location sensitive. Even within Snohomish County, there are zip codes, communities, and even neighborhoods that defy the numbers discussed below. Of course when you zoom out and look beyond Snohomish County, or even Washington State, you will likely see dramatic difference from the specific housing data and trends I’m discussing below.

You can view the latest Snohomish County housing data and charts along with other key housing and economic data here: www.joefrankrealtor.com/data

If you’d like to learn about a different area whether within Snohomish County, or beyond, please contact me at joe.frank@exprealty.com and I’d be happy to provide you such data and an analysis.

If you’re curious about where the Snohomish County housing market stands and what might be coming as we head toward the end of 2024 and into the 2025 spring selling season, you’re in the right place!

This quick breakdown takes a look at the latest data on things like home prices, how long homes are staying on the market, and whether buyers or sellers have the upper hand right now.

Plus, I'll also touch on how mortgage rates and broader economic trends are shaping the market.

If you have questions or want a deeper dive into anything, I’d love to chat - feel free to reach out anytime!

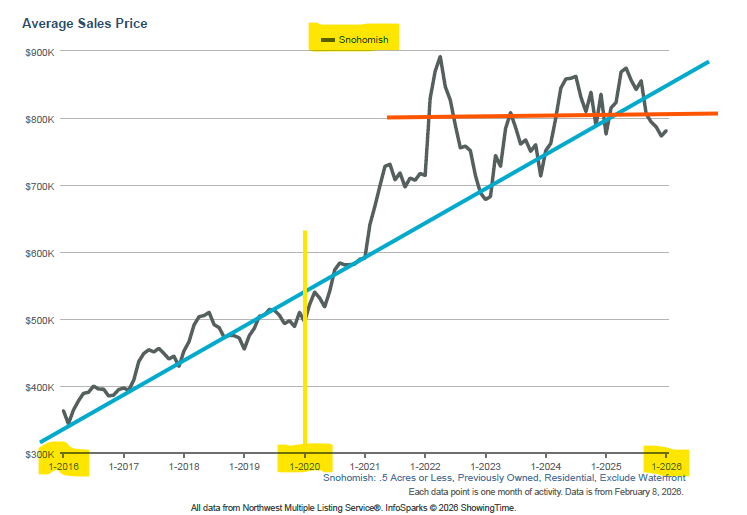

Sale Prices

The Average Sales Price for November took a sizeable drop from October's average sale price. This is not to surprising as we're in the midst of the Holidays and winter months. We're still down significantly from the highs in April 2022 (average sales price of $891K) and even the highs of 2024 in July ($861K), but prices have been relatively stable over the last several years. Currently seasonality and a recent run up in mortgage rates is driving the price drop from October. New home construction is likely also keeping prices in check.

Sellers are typically closing deals at slightly less than their original asking price, which is more in line with a balanced market. On average, homes are selling for 1.9% under the original asking price.

What this means: Buyers have a bit more negotiating power now, but it’s not a bargain hunter’s market. Sellers: Pricing your home competitively is still crucial.

New Listings and Homes for Sale

New Listings have steadily decreased from summer highs, which is typical as the market cools in winter. Fewer homeowners list during this season.

The total Homes for Sale has also dropped compared to earlier this year, showing inventory tightening.

What this means: With fewer new options entering the market, buyers might find it harder to shop around, potentially pushing prices up slightly, especially for move-in-ready homes.

Pending Sales

Pending Sales are lower compared to earlier in the year, reflecting a slowdown in buyer activity, which is expected during the holiday season.

What this means: While activity is quieter now, serious buyers who are still shopping may face less competition, which could work in their favor.

Showings to Pending

The data shows it’s taking 15 showings on average to get homes under contract. This number has been consistent for 3 months and only up slightly from the peak spring selling season.

What this means: Buyers in the market right now tend to be motivated, which is why deals are happening faster. This trend could make sellers more confident to list even during the slower season.

Average Days on Market

Days on Market has crept up as homes are taking longer to sell compared to the spring and summer markets which of course is completely normal.

What this means: Sellers need to adjust their expectations. Homes that are priced correctly and staged well still move relatively quickly, but overpricing can lead to extended time on the market

Looking Ahead to Spring

Winter Trends: We’ll likely see fewer listings and a slight dip in prices in the next few months, but these are normal seasonal shifts.

Spring Expectations: As we head into the busier spring market, expect new listings to pick up and buyer activity to rebound. However, mortgage rates and broader economic conditions will play a huge role.

Influence of Mortgage and Bond Rates

10-Year Treasury Yield: Mortgage rates often follow the 10-year bond yield. If it trends lower, we might see some relief in mortgage rates, encouraging more buyers. Conversely, stubbornly high rates will continue to dampen demand.

What to Watch: Any hints from the Federal Reserve that rate cuts will continue, for how long, and how deep could positively impact the housing market.

Impact of Political Transitions

With the U.S. heading toward a new administration in 2025, uncertainty can sometimes lead to cautious decision-making among buyers and sellers.

For now, housing trends are more likely to be influenced by economic conditions (e.g., inflation, job growth) rather than immediate political shifts and policies. As long as there are no surprises, the housing market should be good.

Friendly Advice

For Buyers: This quieter season might be a great time to snag a home without facing intense competition.

For Sellers: Winter sales are absolutely possible if you focus on good pricing and presentation. Serious buyers are still out there, even in December!

Looking Ahead into 2025

So, what’s the big picture? The Snohomish County market is cooling down as we head into winter, but that’s totally normal for this time of year, and the new year often brings a fresh wave of interest from buyers and sellers.

If mortgage rates stabilize, we may see more buyers ready to re-enter the market with confidence. If rates remain elevated, buyers may continue to have the upper hand, and we could see a gradual increase in inventory.

Either way, Snohomish County remains a highly desirable area, and the long-term value of homes here is strong.

As always, whether you’re buying or selling, I’m here to guide you through the Snohomish County housing market. My goal is to help you make informed decisions, get the best deal possible, and feel confident every step of the way. Let’s make your next move a smart one!

Please remember, I’m providing opinions on Snohomish County housing data only. Housing markets vary greatly from one market to the next, and even from neighborhood to neighborhood.

If you'd like to learn more about the Snohomish County housing market - whether by zip code, community, or neighborhood - or if you're curious about other counties, cities, or states, and the best times to buy, sell, or rent, please contact me.

I love talking real estate, so always happy to discuss with you (of course at no cost or obligation)!

To view the Snohomish County housing trends, mortgage rates, and other data that I used for this market update, please visit: Joe Frank Realtor Data

Thank you for taking the time to read this article!

And as always, if you have any questions or comments, please feel free to leave below, email, text, or find me on social.

Cheers!

-Joe

Listen to the podcast for this blog article:

note: this podcast is AI created from this blog article.

Comments