Snohomish County Real Estate Trends and Insights for October 2023

- Joe Frank

- Nov 12, 2023

- 5 min read

The Snohomish County real estate market for October 2023 is experiencing a slowdown, both in sales, and prices. Inventory is still historically low, however, if you’re considering purchasing a home, now may be a good time to consider as buyers have more negotiating power. On average in Snohomish County, homes are selling for slightly under asking price (1% under).

For October 2023 and on, I'll be moving away from the detailed analysis of Snohomish County Real Estate market data and associated trends, and shift my focus to a more macro level analysis, as well as topics that may be at front of mind.

If you have any specific questions about our local housing market, please feel free to contact me and I'd be more than happy to share my data and insights. You can contact me here, or leave a comment at the bottom of this article. You can also continue to access local Snohomish County real estate and economic trend data here.

Snohomish County Home Affordability – At All Time Low

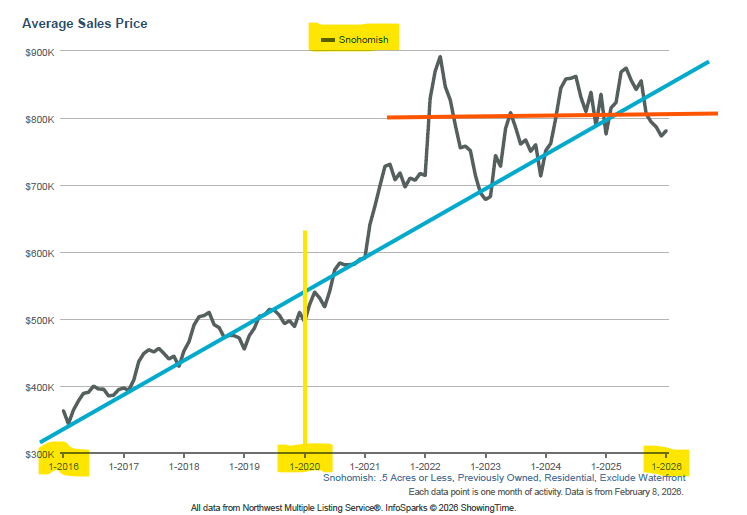

The primary issue for most potential homebuyers is that affordability is at an all-time low. Though prices have steadily declined over the last several months from recent highs in July 2023 (average was $807,000), mortgage rates unfortunately have continued to climb, reaching 8% (and beyond depending upon your credit rating) making the average home, or even starter home in Snohomish County unattainable for the vast majority of buyers.

Following is an example for an average priced home under three scenarios using Snohomish County Housing Data along with national average mortgage rates for the average consumer and credit rating. These scenarios only provide a very notional monthly payment due to the variability of mortgage rates, when a buyer “locked in” their rate, and actual home sales date, so basically I’m saying the following will give you a rough idea of how affordability has morphed over the previous three, almost four years.

January 2020

Average Snohomish County Home Price: $495,000

20% down payment: $99,000

Average 30 year fixed rate mortgage: 3.25%

TOTAL MONTHLY PAYMENT (incudes property tax & insurance): $2,145

Total Interest paid over life of loan: $224,430

April 2022

Average Snohomish County Home Price: $892,000

57% increase in home value from January 2020

20% down payment: $178,400

Average 30 year fixed rate mortgage: 4%

TOTAL MONTHLY PAYMENT (incudes property tax & insurance): $4,128

Total Interest paid over life of loan: $512,861

October 2023

Average Snohomish County Home Price: $751,000 (17% decline from April 2022, but still a 40% increase from pre-COVID home values).

20% down payment: $150,200

Average 30 year fixed rate mortgage: 7.2% (this would be the rate a buyer was privy to when they made an offer in September)

TOTAL MONTHLY PAYMENT (incudes property tax & insurance): $4,625

Total Interest paid over life of loan: $867,337

Examining real world numbers (albeit averages) can be pretty eye-popping. Average monthly payments in less than four years increased 73%! The amount paid in interest on a 30 year mortgage increased from $224,000 in early 2020 to $867,000 in late 2023. This is truly incredible and helps (at least for me) to better understand the affordability dilemma that’s running rampant in Snohomish County, and well beyond.

A Home Price Correction in the Cards?

Will home prices “correct” back toward pre-COVID home values? It seems unlikely. Nevertheless, it such were to happen, there would likely be other, much more concerning events happening in financial markets, and possibly beyond.

There are methods to combat affordability as a potential buyer in this current environment, though not feasible for many – pay all cash or put a significant amount of money down toward the purchase price.

These approaches of course require buyers to have a significant amount of available cash. For the vast majority, and especially first-time home buyers, this is quite unlikely.

Unless you have investments you can liquidate (stocks, bonds, crypto, etc) or savings you can tap, asking family for assistance may be another option.

Family member assistance could come from a cash gift or a low, or no interest loan. This article from Chase provides more details on the requirements and limits for a monetary gift from family.

The other option which many would-be home buyers are now doing, is simply waiting and continuing to rent (or stay at home with parents) until home prices and/or interest rates decline. This also affords future home buyers the opportunity to save for a down payment and ensure their credit rating is great shape.

One last tactic to consider if not tied to the Seattle Metro area, is to consider moving to a lower cost region in WA State or within the US. The Seattle metro area (which includes Snohomish County) is one of the most expensive places to purchase a home. There are many other areas within the US where home affordability is significantly better than the Seattle metro. However, be aware that unless you can work remotely, your salary may adjust downward.

What Will The Winter Season Hold?

If October’s data is foreshadowing the coming months, we may continue to see Snohomish County home price’s decrease, which is the result of traditional housing market seasonality.

However, when you consider such high mortgage rates, we could see accelerated downward pricing pressure.

The one wild card which will likely prevent significant price decreases in the coming is the lack of housing inventory (the same variable that’s been preventing home prices from falling dramatically with such high mortgage rates). The only way out of the lack of inventory is if builders continue to build and/or there is significant forced selling (driven by a recession and unemployment).

Snohomish County Listings and Inventory – October 2023

New listings in Snohomish County have been dropping since August (from 546 to 393, October), but homes for sale (housing inventory) has been increasing from May to September. For October there was a slight dip from September (from 463 to 434). This indicates homes are sitting on the market, which the metric "Days on Market" (how many days’ homes are listed for sale before an offer is accepted) has been increasing since June, and at 20 days for October 2023. Interestingly, this is quite close to pre-COVID numbers in October of 2019.

More than likely, days on market will continue to increase, and inventory decrease through January. Based on historical averages, pricing will likely continue to trend downward or flat line.

Interest rates continue to play a pivotal role and could ignite the housing market even in the winter months if they were to see a substantial decrease, which could bring a rush of buyers, and drive up prices due to the limited winter housing supply.

In Summary

The Snohomish County real estate market in October 2023 is undergoing a slowdown in both sales and prices. Although inventory remains historically low, potential homebuyers have increased negotiating power, with homes selling, on average, slightly below asking price.

Affordability is at an all-time low due to declining prices and rising mortgage rates, making homeownership challenging for many. We looked at housing and interest rate scenarios from January 2020 to October 2023, which revealed a significant increase in average monthly payments and total interest paid on a 30-year mortgage – pretty incredible – and not sure how young folks are able to purchase a home in this environment.

The likelihood of a home price correction to pre-COVID values seems unlikely. Combatting affordability requires substantial cash funds. Some options for first-time home buyers include seeking family assistance or waiting, renting, and saving for a down payment. Moving to a more affordable region is also suggested, but be sure your considering salary adjustments.

Looking ahead to this winter season, the market may see further price decreases influenced by normal seasonality and the sustained historically high mortgage rates. However, the lack of housing inventory will likely prevent any significant price declines / buyer relief. The market's trajectory could change with a substantial decrease in interest rates, potentially leading to increased buyer activity and higher prices.

Overall, our Snohomish County market presents challenges for buyers (especially first-timers), emphasizing the importance of strategic financial planning and consideration of regional alternatives.

Thank you for taking the time to read this article!

Cheers!

-Joe

Comments