Snohomish County Housing Market Update — February 2026

- Joe Frank

- 6 days ago

- 7 min read

Most housing market updates focus on “what happened last month.” Helpful… but also kind of like judging a movie by one scene.

For February’s market check-in (using data through January 31, 2026), I’m doing something a little different: looking back 10 years for this time of year to see what “normal seasonal behavior” looks like - then comparing that to what’s happening now in Snohomish County and Zip code 98296.

This matters because as inventory creeps up, buyers and sellers are starting to get something we haven’t had much of lately: options (and a little breathing room).

The 10-year story, in a nutshell

Prices are still far above where we were 10 years ago, but the “how fast it sells” and “how close to asking it sells” feel a lot more like a normal market than the 2021–2022 rocket-ship era. Let’s break it down.

Snohomish County Housing Market Update: A 10-Year Lens & What’s Happening Now

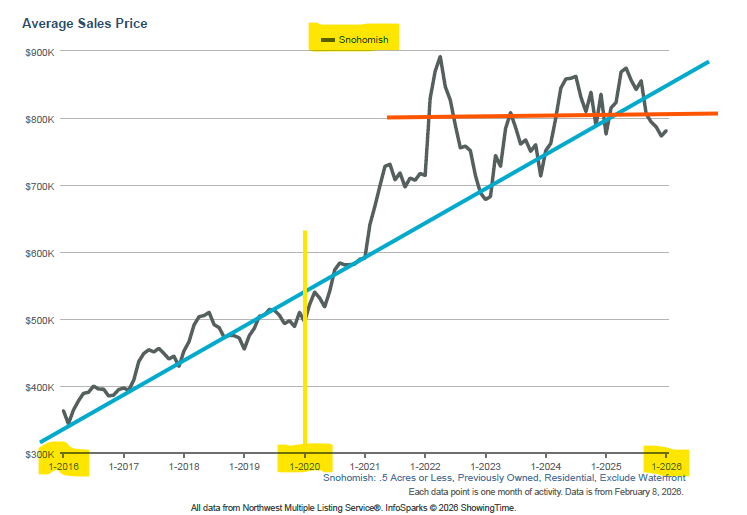

Prices: Still high, but no longer “straight up and to the right”

Snohomish County’s average sale price has roughly more than doubled from the 2016 era to today (think “$300Ks–$400Ks” back then vs. “mid-$700Ks” now).

What’s most interesting in the shape of the last 10 years:

2016–2019: Steady climb

2020–2022: A sharp surge (the “everything is a bidding war” period)

2023–2026: Choppier movement - more back-and-forth, more “rate-sensitive” behavior. This choppiness is a big deal: It’s the market telling us buyers are still buying - but they’re not paying “anything, anytime” anymore.

The last 12 months (Snohomish County prices)

Over the last year, average sale price is basically flat overall, with normal seasonal ups/downs mixed in (rates are a big part of why it hasn’t been a smooth climb).

The last month (Snohomish County prices)

From the most recent month to the prior month, it’s a small move - not a shock-drop or a surprise spike. That’s typically what we see when the market is behaving more “normally” for winter.

Days on Market: This market is giving buyers more time

Here’s a stat that quietly changes everything: Days On Market (DOM) are meaningfully higher now than the peak frenzy years.

When DOM rises, it doesn’t mean “doom.” It often means:

Buyers can actually schedule a second showing

Inspections aren’t treated like an inconvenience

Sellers need to work harder on strategic pricing, marketing, and home / yard presentation

Over the past 10-year period, Snohomish County had accelerated pricing conditions, especially from mid-2020 to about April 2022, then a clear re-normalization toward mid–2022 to where we find ourselves currently in early 2026.

Inventory: Creeping up (and yes, that matters)

Inventory is the ingredient that changes the “feel” of the market the most.

Snohomish County's number of homes for sale is up materially vs. last year (and well above the ultra-low inventory years). More homes for sale typically means:

Price stabilization, or even price decreases.

More competition between listings

Fewer “panic offers”

Buyers can be pickier about layout, commute, inspections, repairs, and price!

New listings: Sellers are testing the waters again

New listings (supply coming onto the market) is one of the best “confidence signals.”

When listings rise, it often means:

Sellers believe they can get a reasonable price

“life happens” moves are returning (job change, life changes, downsizing, upsizing)

People are less frozen by the rate lock-in effect than they were

Percent of Original List Price: The negotiation era is back (a little)

During the hottest years, homes often sold at or considerably above list price. In today’s charts, the “sold over list” vibe is far less dominant, and the average has cooled notably from that peak period.

This lines up with what many buyers feel on the ground:

Some homes still go fast (if priced right and in great condition)

But the majority of homes need price adjustments or concessions to get the deal done

Zip Code 98296

Just to get some very local perspective, let’s zoom into 98296, where price points are higher and buyer expectations can be… let’s call it “more particular.”

I can pull this same data for any WA state zip code, or even neighborhood if you're looking to better understand your specific local market.

Prices: Still near the high end of the last decade, but more rate-sensitive

Over the last 10 years, 98296 shows the same big arc: steady pre-2020 growth, a big 2021–2022 surge, then a more uneven pattern afterward.

In the most recent year, the price trend looks a bit softer than Snohomish County overall — consistent with higher-priced areas being more sensitive when mortgage payments jump.

Days on Market (DOM): Longer than the frenzy years (but not “stuck”)

DOM in 98296 has moved higher than the ultra-fast years, which again usually means: buyers have more time, and sellers have to be sharper.

Inventory + New Listings: Fewer new listings recently, inventory not exploding

This is a key nuance: In 98296, recent new listings are lower than they were a year ago, and inventory doesn’t look like it’s ballooning the way some people assume.

That combination often produces a market that feels like:

Fewer “perfect fits” show up

Well-priced homes still attract attention

Buyers may be negotiating more, but they can’t assume endless supply

Percent of original list price: Still cooler than the peak years

98296 also shows a noticeable comedown from the peak “over list” era - more normal negotiation, fewer automatic bidding wars.

The “Why” Behind the Market: Rates, the Fed, and what could happen next

Where rates are right now

Freddie Mac’s weekly survey shows the average 30-year fixed rate at 6.11% (Feb 5, 2026), down from about 6.89% a year earlier.

That’s meaningful. A ~0.75% rate drop year-over-year helps affordability even if prices are sticky.

What the Fed is doing (and why it matters to mortgages)

As of January 29, 2026, the Fed’s target range for the federal funds rate is 3.50%–3.75%.

Important nuance (in plain English):

The Fed doesn’t set mortgage rates directly

Mortgage rates are more closely tied to the bond market (especially the 10-year Treasury)

BUT the Fed influences expectations about inflation and future rates - which feeds into mortgage pricing

The “New Fed Chair” Dynamic

Donald Trump announced Kevin Warsh as the nomination as the next Fed Chair on 1/30/26, but he must still be confirmed by the senate before current Fed Chair Jerome Powell's term ends May 2026. There's been ongoing public discussion about what Warsh's approach could mean (including debate about inflation, productivity/AI, and the Fed’s balance sheet), but at this time, it's all speculation.

At the same time, Jerome Powell is still heavily in the news as chair in recent coverage, which highlights that leadership transitions and politics around the Fed remain a live issue influencing stock markets and bond interest rates.

What might a new chair change for mortgage rates?

Even if a chair wants lower rates, the Fed can’t simply “wish” mortgages down without inflation cooperating. Also, if the Fed becomes more aggressive about shrinking its balance sheet, some analysts warn that could push long-term rates higher, not lower.

So the realistic takeaway for buyers and sellers: Mortgage rates can drift lower, but they’re still likely to be “earned” through improving inflation and stable growth —not just a personality change at the top.

My simple, forward-looking take (National, Snohomish County, and locally in 98296)

Here’s how I’d translate all this into real life:

If You’re a BUYER:

You have much more leverage than you did a few years ago - not because prices collapsed, but because:

You have more time, and choices (inventory is higher in the broader county)

Homes take longer to sell (more time for due diligence)

Negotiation has returned (closer to/under list on average vs. peak years)

If You’re a SELLER:

The market will still reward you - IF you do the basics exceptionally well:

Price it appropriately

Prep it like you’re competing (because you are)

Expect buyers to ask questions and request concessions

If you’re watching 98296 specifically:

The recent pattern suggests:

Fewer new listings

Inventory not surging

Buyers still negotiating harder than peak years

That tends to create a market where great homes still move, but “pretty good and overpriced” will tend to sit.

Final Thoughts: What This Market Is Really Telling Us

When you zoom out and look at 10 years of February data, a few things become clear.

Prices remain historically high, but the pace of the market has cooled. Homes are taking longer to sell, negotiation has returned, and inventory, while not exploding has improved enough to give buyers and sellers real choices again.

This isn’t a boom-and-bust moment. It’s a transition. The market feels more thoughtful, more selective, and more sensitive to pricing, condition, and interest rates than it has in years.

For buyers, that means time to ask better questions and make informed decisions. For sellers, it means preparation and strategy matter more than ever.

If You’re Thinking About Buying

If you’re considering a purchase now or in the next 6 to 12 months, this is a good time to:

Get clear on your budget and comfort level at today’s interest rates, not just what you hope rates might do later.

Take advantage of longer days on market to conduct proper due diligence and second showings.

Focus on quality and fit, not just “winning” a house.

Have a plan for rate changes - whether that’s buying now and refinancing later, or waiting intentionally with clear criteria.

The buyers who are doing best right now are informed, patient, and decisive when the right home shows up.

If You’re Thinking About Selling

For sellers, the key question is no longer “Will it sell?” but “How should I position it?”

Pricing accurately from day one matters more than ever.

Presentation and condition can dramatically impact days on market and final price.

Understanding what buyers are pushing back on in your local market - price, repairs, concessions - helps avoid unnecessary time on market, and potential sales price decay.

Sellers who prepare well and price realistically are still seeing strong results, especially for homes that stand out in their category.

If You’re Not Ready Yet

If you’re in the “maybe later” camp, the best next step is simply to stay informed:

Track how inventory, prices, and rates move over the next few months.

Watch your specific neighborhood or ZIP code - not just headlines.

Start conversations early, before decisions feel urgent.

Real estate works best when it’s proactive, not rushed.

One Last Thought

Markets change, but good decisions are timeless. The advantage right now isn’t timing the market perfectly - it’s understanding it well enough to move forward with confidence when opportunity arises, and fits your plans and goals.

If you’d like help interpreting what this data means for your situation - whether buying, selling, or just planning - I’m always happy to be a resource.

Thank you for taking the time to read!

Cheers,

-Joe

NWLS - ShowingTime Reference Trends and Data for Snohomish County and zip code 98296

Comments