March 2025 Fed Speech: Latest on U.S. Economy & Seattle Housing

- Joe Frank

- Apr 3, 2025

- 3 min read

Updated: Jun 22, 2025

Lets dive into what Fed Governor Lisa Cook recently had to say about the U.S. economy and what it all means for our local Seattle housing market. Grab a cup of coffee (or whatever your go-to drink is) and let’s break this down in plain English.

The Big Picture: A Rollercoaster Ride of Economic Uncertainty

So, Lisa Cook, a Federal Reserve Governor, just gave a speech that basically said, “Hey, the economy is still chugging along but people are nervous.” And when I say nervous, I mean record-breaking mentions of “uncertainty” in the Fed’s Beige Book—a whopping 45 times, compared to just 12 last year. Yikes.

She pointed out a few important things:

Inflation has cooled off quite a bit, dropping from a sky-high 7.2% in mid-2022 to 2.5% as of February 2025.

Unemployment remains low, hanging around 4.1%, which is historically pretty good.

Consumer spending and business investment? They’re slowing down—think of it as everyone pumping the brakes a little.

In response, the Fed has kept interest rates steady between 4.25% and 4.5%. They’re basically saying, “Let’s wait and see what happens next.” It’s like trying to bake a cake without burning it—don’t add too much heat or it’ll all fall apart.

If the recent tariff implementations (4/2/25) drive up prices /inflation, and begin to stall the economy (such as increasing job losses/unemployment, loan defaults, foreclosures, etc), we could see the Fed lower rates more aggressively, but only time will tell.

Inflation, Productivity, and… AI? Oh My!

Lisa Cook talked about inflation being mostly under control, but it’s been a bumpy ride. Housing prices have been sticky, and those restaurant meals, flights, and even financial fees are still feeling pretty expensive.

What’s interesting is that productivity has actually improved. Cook credits a lot of this to new businesses popping up and, surprise surprise, AI technology. She believes AI could boost productivity over the long haul, similar to how computers did back in the day. Good news for Seattle’s tech scene, right?

So, What Does This Mean for the Seattle Housing Market?

Alright, here’s where things get juicy. Let’s break it down:

Mortgage Rates:

With the Fed holding steady on rates, mortgage rates are likely to remain elevated but not skyrocket. So, no panic there.

If you’re planning to buy, you might find mortgage rates that aren’t ideal but aren’t nightmare-inducing either.

Housing Demand:

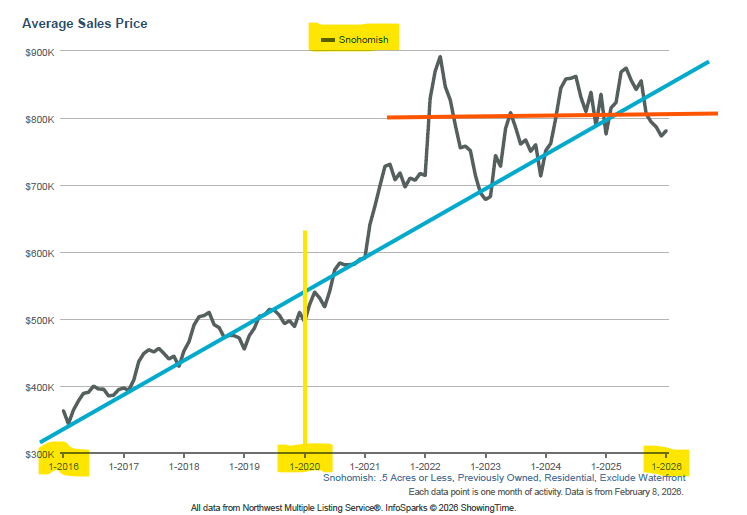

The Seattle area is still a hot market, but a slowing national economy might cool things off just a bit.

If you’re selling, it’s not a bad time, but pricing your home correctly is going to matter more than ever.

Rents:

Rent prices have been stabilizing, but there’s still high demand. Especially with Seattle’s ongoing housing supply issues. So, if you’re renting out a property, you’re probably still in good shape.

Investor Confidence:

Tech innovation (especially AI) continues to drive the Seattle market. It’s not a stretch to think that the region could benefit from increased productivity gains.

But uncertainty around trade policies and general economic direction could make some investors hesitate.

Bottom Line: Seattle’s Market Will Probably Be Just Fine… With a Few Bumps

Lisa Cook’s speech makes it clear that while the national economy might hit some turbulence, Seattle’s strong tech foundation and general desirability could help it ride out the storm.

If you’re thinking of buying, selling, or investing - especially in the Seattle metro area - it’s important to stay informed and stay flexible.

Got questions about how the latest Fed news might affect your specific situation? Drop me a message!

Talk soon!

– Joe Frank

You can listen to the podcast for this article below. Please note that the podcast is AI generated from this blog article.

Comments