July 2023 - Snohomish County Real Estate Trends

- Joe Frank

- Aug 26, 2023

- 10 min read

Updated: Aug 27, 2023

To see the latest real estate trend charts from January 2022 to July 2023 for Snohomish County, please check out my Housing Market & Economic Data page which offers charts that are updated monthly in real time.

Please note that for this month, and moving forward, I've removed condominiums or "condos" from the Snohomish County dataset. After analyzing past and current data / trends, I've decided to have my monthly analysis focus strictly on single family residential homes (0.5 acre or less, previously owned, and excluding waterfront property). If you would like any real estate data on condos in the Snohomish County area (or beyond), just drop me an email and I'd be happy to provide to you.

Due to the elimination of condo real estate data, I can no longer compare the previous month(s) data so I'll be starting from scratch with below data and analysis, and for all future analyses. The refreshed data is not significantly different with the subtraction of condo data, but it wouldn't be an "apples to apples" comparison.

The following data and charts represent monthly Snohomish County real estate trends from January 2022 to July 2023.

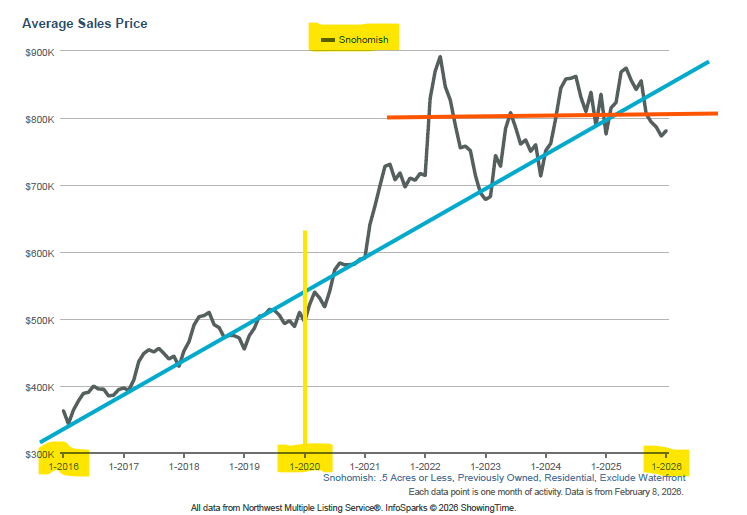

1. Snohomish County Real Estate Trend - Average Sales Price

For July 2023, the average sales price was $787,000 for Snohomish County.

July's home prices shows the first decrease since April (even with the removal of condo data).

This is likely a result of getting deeper into the summer months and increasing mortgage rates.

To review the most recent trend data, please check out the Housing Data page here.

Average sales prices is a lagging indicator. These prices in most cases were agreed to one to two months ago (when an offer was accepted). Additionally, the fall and winter months are historically slower and prices tend to decline, and the late winter and spring (February through May), prices tend to rise. During the summer months prices tend to stabilize however will trend lower as we get closer to children heading back to school and the fall months.

2. Average Days on Market

Average Days on Market (DoM) indicates how many days a house is listed for sale (“on the market”) before an offer is accepted. When Days on Market increases, it indicates home buying demand is softening. This normally result in less offers, more buyer contingencies, increased housing supply, and ultimately, decreasing home prices.

For July 2023, DoM increased to 13 from June's number of days at 11. This data is the same with and without condo data.

Seasonality is at play - generally speaking - late February to May are the highest demand months for buyers (and when most sellers try to list). As we get into late summer and heading toward fall, it's quite likely we'll see Days on Market continue to increase.

To review the most recent trend data, please check out the Housing Data page here.

If you're looking to buy, you should be rooting for the Days on Market to be around 30 to 40 to ensure a more balanced market (where sellers don't have all the leverage).

3. Pending Sales

Pending Sales can be a leading indicator of what home sales will be within the next 30 to 60 days (the average time to close on a home once an offer has been accepted). Not all pending sales will close, however on average, 80% make it through closing and become a finalized home sale.

For July 2023 data, Pending Sales were 472 for Snohomish County.

To review the most recent trend data, please check out the Housing Data page here.

4. Quantity of Homes For Sale (in MLS)

This metric indicates how many homes are listed for sale within the MLS in Snohomish County. It’s also referred to as housing inventory or supply.

For July 2023, the number of homes for sale was 388. We peaked in July 2022 with 1,200 homes for sale on the MLS.

Overall, the current number of homes for sale is still historically very low. The average number of homes for sale at any one time in Snohomish County over the past 10 years is about 700. The drastic decline directly correlates to the sustained mortgage rate increase, and therefore "home affordability". This affects both builders and home owners considering to build or sell, respectively.

To review the most recent trend data, please check out the Housing Data page here.

Along with higher mortgage rates, the lack of home supply is the main culprit to home prices remaining elevated. This is Econ 101 stuff - if there were more homes for sale (supply) then demand would lessen, and help drive down home prices, ultimately improving affordability.

To increase supply, you need more homes!

Another significant factor is that resale or "previously owned" homes for sale is very low due to the mortgage lock-in effect.

5. New Listings

The New Listings data can help shed light on the health of our local housing market and whether we're trending toward a more healthy and balanced market relative to housing inventory / supply.

New listings is also influenced by the time of year - the peak season to list a home for sale is generally from about February to May.

To review the most recent trend data, please check out the Housing Data page here.

For July 2023, new listings dipped down to 552.

I would suspect a downward trend to continue as we're now well out of the peak home selling season and heading toward fall, where historically listings decrease and buyer demand wanes.

6. Average Percent of Last List Price

This chart indicates the final sales price of a home over or under the original list price on the MLS. As you can see, Snohomish County hit a peak in March 2022 of 115%. This means, on average, in Snohomish County, homes were selling for 15% above the listed price. Example: A home was listed for sale at $700,000 and sold for $805,000.

To review the most recent trend data, please check out the Housing Data page here.

For July 2023, single family homes sold for 1.4% above the original listing price on average.

7. Average Shows per Listing

The average number of people physically visiting and viewing homes for sale with a real estate agent.

For July 2023, viewings were 9.3 on average. The trend continued lower as we transition out of the peak selling season (February to June).

To review the most recent trend data, please check out the Housing Data page here.

Further house showing data details for all regions of US available here from ShowingTime.com

8. Mortgage Application Data

Another key (and more real-time) metric to monitor the health of the housing market, as well as what we may see in the future, is Mortgage Application Data. This data tells us how many people are applying for a mortgage in preparing for a home purchase for the previous week.

New data is released every Wednesday, 7:00AM (PST). You can learn more at MBA.org as well as subscribe to their weekly email so you don't miss a beat!

This past week's data (8/23), showed yet another decline, yet very much anticipated due to the increasing interest rates. I suspect next week's mortgage applications will take another dive as rates remain elevated - not to mention we hit the highest mortgage rate in about 20 years on 8/22/23 at 7.49%!

To gain a broader sense on the health of our local housing market and economy, following is some data and perspective on unemployment data along with new single family home construction permits. Such data can show signals and trends on the health of the economy, and ultimately the housing market.

9. Housing Affordability - Snohomish County

Housing Affordability has been decreasing since the start of 2021. Affordability has worsened recently due to continued high home prices coupled with mortgage interest rates that have doubled from the lows in 2020 and 2021.

The Housing Affordability Index (HAI) is updated quarterly and uses three key variables:

Median Home Prices

Median Household Income

Mortgage payment Cost (and assumes a 20% down payment).

Per the AWB Institute, the HAI is calculated by the Center for Real Estate Research (WCRER) at the University of Washington. The HAI helps illustrate the ability (or inability) of middle-income households to make a mortgage payment on a median priced home.

"Affordable" in the space of this index equates to a household not paying more that 25% of their income toward the mortgage (principal and interest only).

A Housing Affordability Index of 100 is considered "affordable" (and a mortgage payment is exactly 25% of income). Below 100 is considered less affordable (or not affordable as you sink toward 0). Above 100 is considered more affordable.

The Housing Affordability Index data and chart has not been updated with Quarter 2 data, but it can be found in their data source from the University of Washington's Center for Real Estate Research.

The latest data from Quarter 2, 2023 at 60.4 indicates worsening home affordability within Snohomish County (and many other counties) due to rising interest rates, and home prices that are not budging due to lack of supply.

For reference, the Q1 2023 factor was 68.6 which was up (more affordable) from Q4 2022 of 65.2.

The average statewide Housing Affordability Index is at 57.2. So relatively speaking, Snohomish County is more affordable than many other regions. I suspect this has something to do with increasing wages (including folks moving from Seattle and Bellevue to Snohomish County) which helps maintain or improve home affordability. Two examples to the south and north of Snohomish County: King County is at 56.4 and Skagit County is at 51.3.

Last Updated December 2022. Source: AWB Institute

University of Washington - Center For Real Estate Research

10. Mortgage Rates

The following trend chart from Mortgage News Daily shows the 30 year fixed mortgage rates over the previous 12 months.

30 year mortgage rates were hovering in the high 6 to low 7% range from the end of May 2023 to the end of July 2023. However, from that point they trended upward, hitting a peak of 7.49% on August 2nd, only to remain elevated in the 7.3% range.

It's unknown at this point when (or if) mortgage rates will trend back down toward 4 percent - heck 5% or 6% sound great based on where we're at now! Much will depend on inflation and the Fed's action to combat it with the Federal Funds Rate and how the bond and therefore mortgage markets react.

Higher mortgage interest rates directly affect home affordability and therefore housing supply and prices - no doubt a very important metric to keep an eye on if looking to buy, sell, or refinance.

Average mortgage rate trend data for 30 year fixed mortgage over the last 12 months - August 1, 2022 to August 25, 2023:

Source: Mortgage News Daily

Unemployment

This data is provided monthly by the Washington State Employment Security Department, and has a two month lag.

June 2023 unemployment data bumped up again to 3.4% which is up from May at 3.2%.

According to the Fed, they want to see the national unemployment rate reach at least 4%, as they feel this will help to slow the economy and help curb inflation. However this does not mean the Snohomish County Unemployment will hit that mark, or be immune from reaching above 4%.

As of June 2023, Snohomish County Unemployment was at 3.4%

Previous Months: May 2023 = 3.2%, April 2023 = 2.7%, March 2023 = 2.5%, February 2023 = 2.6%, January 2023 = 3.7%, December 2022 = 3.2%, November 2022 = 3.1%, October 2022 = 3.3%, September 2022 = 3.3%, August 2022 = 3.4%, July 2022 = 3.3%, June 2022 = 3.1%, May 2022 = 2.9%, April 2022 = 2.3%)

Source: esd.wa.gov

New Residential Housing Permits

This data is not provided by county, but rather metropolitan area. In the case of Snohomish County, I’m relying on the “Seattle Metro Area” which is Snohomish, King, and Pierce County data.

Residential housing permits authorize new housing units to be built, but does not indicate if construction has started, or whether it will ever start, or complete (see below for a national and regional perspective on "Starts" and "Completions"). Data from the US Census Bureau has a two month lag.

Seattle Metro area as of July 2023, new housing permits for Single Family Residential (this is 1 unit, also denoted as "SFR"): 489 permits issued

June = 596, May 2023 = 616, April 2023 = 500, March 2023 = 515, February 2023 = 352, January 2023 = 359, December 2022 = 364, November 2022 = 357, October 2022 = 427, September 2022 = 459, August 2022 = 611, July 2022 = 564, June 2022 = 649

Year to date there have been 3,427 SFR permits issued (2022 total = 7,037). Total SFR permits issued for Seattle Metro area through July 2023 is the 36th highest compared to the other 384 major cities and metro areas monitored.

The top US market for the most New Residential Housing Permits (1 unit) in July 2023 is still the Houston-The Woodlands-Sugar Land, TX metro area with 4,108 new single family housing permits.

The lowest US markets for the most New Residential Housing Permits in July 2023 was Morgantown, WV at 1.

For national and regional data and trends on Housing Permits, Starts, and Completions, check out this summary from the US Census Bureau on Monthly New Residential Construction. Source: United States Census Bureau

Additional Reading

For additional reading and market insight, check out the following resources. The data is national, and not localized to the Seattle Metro area. Nonetheless, this is great information to consider in a comprehensive analysis to gain a better understanding of the current, and future health of housing markets - locally, regionally, and nationally.

Home Mortgage Application (and refinance) data. This weekly survey data from the Mortgage Bankers Association (MBA) provides a forward looking indicator on the housing market by examining the number of people applying for home mortgage loans. The numbers are released weekly on Wednesday morning. Tip: Scroll down about halfway on the Mortgage Application Survey page to find the current, as well as previous releases.

NAHB / Wells Fargo Housing Market Index (HMI) is a monthly survey based on responses from NAHB member home builders focused on new single-family residential homes. The survey solicits builders' sentiment on the current housing market, as well as their take on the single family housing market looking outward six months. The survey also provides home traffic numbers. The data provides both a national and regional breakout.

That's A Wrap for July 2023!

I hope this monthly snapshot provides useful and relevant information, trends, and opinion about our local Snohomish County real estate market and economy.

Please let me know in the below comments (or email) if this information is helpful and if you’d like to continue to see it monthly.

If you have any feedback I’d love to hear your thoughts. For those interested, I can also pull data beyond Snohomish County, or drill down by zip code or even neighborhood if you're looking for additional or more specific data.

Thank you for taking the time to read!

Cheers!

-Joe

Comments