Snohomish County Real Estate Health, Trends & Insights for June 2024

- Joe Frank

- Jul 21, 2024

- 3 min read

The Snohomish County housing market as of data from JUNE 2024 shows strong continued strength for home prices and sellers.

Following is an overview and analysis on the latest June data and opinion on what the future may hold for housing prices and interest rates.

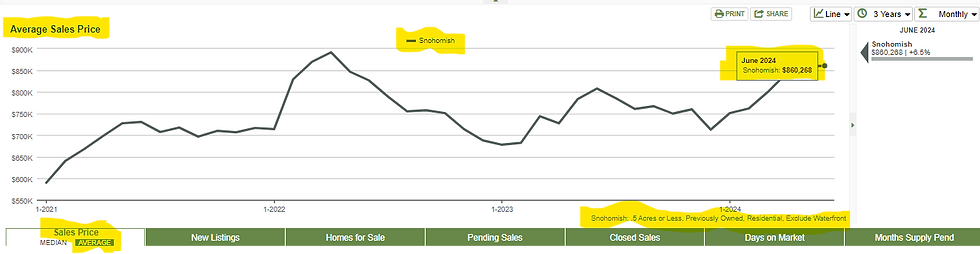

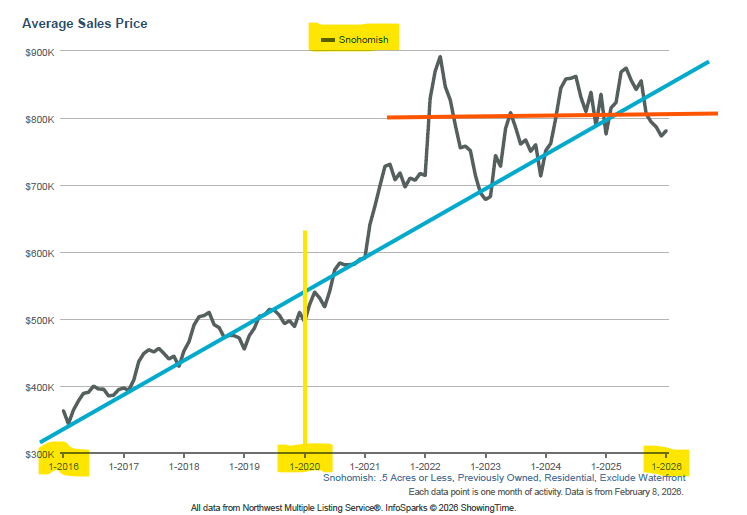

Average Sales Price

June 2024: $860,000

May 2024: $859,000

June 2023: $808,000

Peak: April 2022 ($891,000)

The average sales price in June 2024 was $860,000, reflecting a significant year-over-year increase from $808,000 in June 2023. While prices are slightly down from the April 2022 peak, they remain strong, indicating a robust market.

New Listings

June 2024: 737

May 2024: 785

June 2023: 565

Peak: June 2022 (1,129)

There has been a steady increase in new listings compared to last year, with 737 new listings in June 2024, up from 565 in June 2023. However, this number is still below the June 2022 peak of 1,129.

Homes For Sale (Inventory)

June 2024: 609

May 2024: 503

June 2023: 344

Peak: July 2022 (1,088)

Inventory levels have increased significantly from last year, providing more options for buyers. However, with 609 homes for sale in June 2024, the market remains tight compared to the 1,088 homes available in July 2022.

Average Days On Market

May 2022: 12

June 2024: 12

May 2024: 9

June 2023: 23

Homes are selling quickly, with an average of 12 days on the market in June 2024, showing strong buyer demand and quick turnover.

Average Sale Price as a % of Original Listed Price

June 2024: 101.6%

May 2024: 103.7%

June 2023: 100%

May 2022: 106.2%

Homes are selling for slightly above the list price, with an average of 101.6% of the original listed price in June 2024. This indicates competitive bidding, although less intense than in 2022.

Average Shows to Pending

June 2024: 12

May 2024: 14

May 2022: 13

The average number of showings before a home goes pending is 12, suggesting that buyers are making quicker decisions in the current market.

Market Analysis and Future Outlook

Current Market Dynamics:

Seller's Market: The combination of rising prices, quick sales, and homes selling above the list price confirms that Snohomish County remains a strong seller's market.

Improving Inventory: While inventory levels have increased, they remain lower than in 2022, indicating ongoing supply constraints.

Impact of Interest Rates:

Current Rates (July 2024): The Federal Reserve has maintained interest rates (the Fed Funds Rate) between 5.25% and 5.50% (as of 7/15/24, it's 5.33%), keeping borrowing costs high and somewhat limiting buyer affordability.

Expected Rate Changes: Anticipations of the Fed cutting interest rates later in 2024 (September, and potentially November and/or December), would bring the Fed Funds rate to around 4.00% to 4.25%, which could enhance buyer affordability and stimulate further market activity.

Likelihood of Future Fed Rate Cuts: Use the CME Fed Funds Watch tool here to monitor the chances of future rate cuts. The tool is currently indicating (as of 7/21/24) there's a 94% chance of a rate cut in September (2024), a 57% chance of another rate cut in November (2024), and a 50% chance of third rate cut in December (2024). If all three cuts were to actually happen, the Fed Funds rate would be at 4.50 to 4.75% (vs current 5.33%).

Outlook for Remainder of 2024 and into 2025

Continued Seller Advantage: Sellers will likely continue to benefit from high demand and low inventory throughout 2024.

Potential Buyer Relief: Expected interest rate reductions could lower mortgage costs, making homes more affordable and attracting more buyers into the market.

Stable to Modest Price Growth: Prices are expected to stabilize or grow modestly, balancing between the current strong demand and the anticipated increase in buyer activity due to lower interest rates.

Summary

The Snohomish County housing market is demonstrating strong health with increasing prices, quick sales, and rising inventory levels. Buyers should act swiftly in this competitive market, while sellers can expect favorable conditions to persist throughout the year. Potential interest rate cuts could further invigorate the market, possibly benefiting both buyers and sellers.

Please remember, I’m only reviewing and providing opinions on Snohomish County housing data. Housing markets vary greatly from one market to the next, and even from neighborhood to neighborhood.

If you want to learn more about the Snohomish County housing market—whether by zip code, community, or neighborhood—or if you're curious about other counties, cities, or states, and the best times to buy, sell, or rent, please contact me. I'm happy to discuss this with you at no cost or obligation.

To view the Snohomish County housing trends, mortgage rates, and other data that I used for this market update, please visit: Joe Frank Realtor Data

Thank you for taking the time to read this article!

If you have any questions or comments, please feel free to comment below, email, text, or find me on social.

Cheers!

-Joe

Comments